Why are interest rates low?

Mish Moved to MishTalk.Com Click to Visit.

Here is an interesting article by Bud Conrad on why interest rates are low. His assertion is that "Interest rates are low because of newly created money".

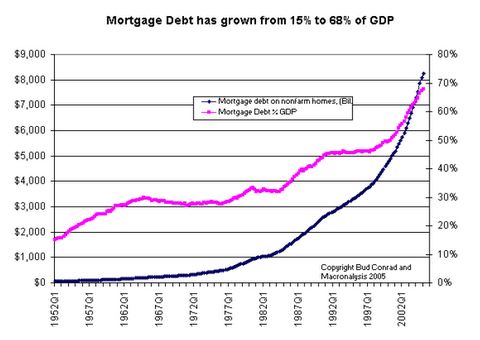

I applaud the work it takes to produce such an article, especially one with as many excellent graphs that Mr. Conrad put together. Here is my favorite:

If you are looking for a case for inflation, he concludes with:

"The problem of an expanding credit bubble is that it results in prices rises in a series of asset bubbles like housing now and commodity prices like oil. These are the specific signs of pockets of price inflation that is the result of the money creation. The loss in purchasing power of the dollar, especially internationally, is also a symptom of this credit expansion. The wider understanding of this debasing of the currency will lead to higher interest rates as investors demand higher returns to cover the price inflation. The irony of the short-term fix for lower interest rates by creating credit, is that the seeds of future inflation will grow into the reverse with higher inflation, higher interest rates and slowing asset prices."

The preceding paragraph is true as it reflects what HAS happened (especially in regards to housing), but it does not address the more important question which is "where to from here".

I am of the belief that Greenspan's conundrum will be resolved at exactly the worst time for Greenspan. In other words, I expect a spike in interest rates the moment he pauses, and perhaps again the moment he first cuts rates. That will be it. I do not know if that will be with the 10-yr yield rallying from 4.0% to 4.6% or from 3.75% to 4.25% or whatever. I think it will be short lived but it will likely spell the final death to housing. From where we are today however, that is hardly any movement in rates.

Bud does say "We have not had a credit bubble burst as did Japan after 1989 or the US after 1929, but on the contrary we have had an expanding credit bubble."

To which I reply "Exactly"!

We have not yet had our bust. When we do, why should the expectation be any different that what happened in Japan? That is: a crushing blow to housing prices, falling stock prices, falling demand for credit and falling interest rates. When the demand for credit drops, interest rates will follow. The spike I refer to above will be the last gasp of those in the inflation camp to say "lookie here" and one final chance for treasury bulls to get shaken out of the march to all time low yields when the demand for credit shrinks to new lows.

Thanks for the article and graphs Bud, it was very well put together (and anyone who knows me knows I would not say that unless I meant it). That said, housing and inflation are the past and not the future. I think a parabolic mortgage debt chart, covers of two leading magazines espousing housing, and rampant speculation in California and Florida are proof enough.

Note: I may get one more post in later this evening. Otherwise I will likely be gone for about a week.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/