Strike Four

Mish Moved to MishTalk.Com Click to Visit.

Mish note: This post is about jobs. I talked about some of this last Friday in Rear View Mirror Jobs so a portion of this will be repeated. In the meantime I have attempted to figure out where and how the BLS missed the boat on their Birth/Death model and I also have new charts on employment trends as well as a brief discussion on Canada. The US is currently sitting on a called "Strike Four". Perhaps it is more significant that Canada just registered a swinging "Strike Two". Please read on.

MarketWatch reported U.S. nonfarm payrolls rise 113,000 in July.

The U.S. economy added fewer-than-expected 113,000 nonfarm jobs in July and the unemployment rate rose to 4.8%, its highest level since February, the Labor Department said on Friday. The payrolls number was weaker than the 143,000 gain economists surveyed by MarketWatch were expecting. "Overall, too soft to hike," said Ian Shepherdson, chief U.S. economist at High Frequency Economics. Shepherdson said the Fed was now done raising rates.

This is the fourth miss in a row vs. job expectations. I talked about the last miss in "Strike Three".

Birth/Death Model

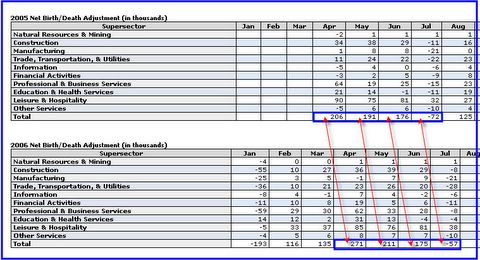

The birth/death model took away 57,000 jobs in July. Those not familiar with the Birth/Death Model should read the afore mentioned "Strike Three" for an explanation otherwise the rest of this discussion may not make much sense.

Absent the Birth/Death adjustment, the jobs number was 170,000 rather than the reported 113,000. Yet, nearly 70% of employment gains this year came from birth/death model adjustments by the BLS.

Is the economy adding more jobs than is shown by the hard payroll data itself, or less? Is the BLS assuming one thing but the economy proving another?

The BLS does not disclose how they compute their birth/death numbers. Why the big secret? Do they know the process is so bad that people would laugh at it if they saw it? There is no doubt that the BLS model will miss the turn. Employment numbers will lag at both the top and the bottom. The BLS admitted that themselves.

But as goes housing, jobs will follow. So when I see marginal growth in jobs at a time housing is falling off the cliff, I am going to be very suspicious of those numbers. There can be no question about it. Housing has fallen off a cliff.

When I looked at today's numbers I expected to see huge negative revisions in the "Birth Death Model" but they were not there.

Here is the chart of Birth/Death assumptions: (click on the image for a larger view)

Housing peaked in July or August of 2005. Yet leading up to that peak we see the BLS assumed a total of 501,000 jobs for the months of April thru July. This year, in the midst of an enormous housing slump, the BLS assumed the creation of 600,000 jobs. Not only that, but the birth/death model only subtracted 57,000 jobs this July vs. 72,000 last July.

This is obviously total garbage. We may not know if 2005 was understated or if 2006 was overstated but we do have a glimpse that at least one set of the BLS's numbers is pure nonsense. No matter how you look at it, there is a problem.

I strongly suspect that the BLS model is looking in the rear view mirror when it comes to jobs. They are currently assuming that the economy is growing faster now in terms of job creation vs. a year ago (not for one month but for a 4 month average), at a time when GDP has fallen to 2.5% and housing starts and home sales have fallen off a cliff. Either that or their model has gone totally haywire.

We may not know what the real numbers are, but we do knows know that relative to last year, the last 4 months of birth/death assumptions from the BLS are insanely optimistic. That to me is useful information.

Had the numbers shown massive declines in the job assumptions for July, it would have been one thing, but the actual numbers shown above for April through July (year over year) are clearly a joke.

Still the reflex action of the market has been to buy bad news. This will work until it doesn't. The longer it "works" the bigger the eventual blowup will be. At some point, job losses will matter simply because they have to. People out of work will not be buying much regardless of whether or not interest rates pause, or even decline.

Employment Trends

The above image is courtesy of UBS. The blue highlights are mine.

Notice the drop off in private sector employment and construction. Leisure and Hospitality is still holding up well as are professional business services and health services. Health services may continue to outperform but what about the others? I suspect they will not for reasons I will address shortly.

My neighbor is an architect, in fact, he customized designed our house. He told me last week that things have stalled and he will have to lay off one of his helpers. He is only one architect but multiply the situation by the thousands over the country and I think we see a dropoff in all kinds of professional services. Am I over extrapolating one local housing market to the entire nation? I think not. Ask Sonnypage. Also look at falling sales and looming inventory in Florida, California, DC, Boston, Phoenix, and many other places.

There is a new Walmart being built near us, and for the sake of argument I will assume they are expanding over much of the country. In essence I am giving the BLS birth/death model the benefit of the doubt because it matches what I see happening, even in this dismal month. I can say the same thing about Pizza Huts, Applebees, and other restaurants. Nail parlors seem to be everywhere. In essence, housing expansion was followed by lots of leisure and hospitality jobs. But as builders stop building new subdivisions, Pizza Huts and Walmarts and nail salons will stop going up around them. I think we are in the final stages of expanding leisure and hospitality jobs as well.

GDP

The BEA is reporting GDP in the second quarter of 2006 slowed from an annual rate of 5.6% to 2.5%.

Here are the numbers for 2005 and 2006:

Q1 05 Q2 05 Q3 05 Q4 05 Q1 06 Q2 06Notice that the huge increase in GDP from the 4th quarter of 2005 at to the first quarter of 2006 produced no new jobs. The economy "boomed" but no jobs were produced. I have a suspicion that part of that boom was a mad rush by homebuilders to complete projects before all hell broke loose on the downside. I don't think they made it.

3.4 3.3 4.2 1.8 5.6 2.5

Although we did not produce jobs we did produce a massive increase in housing inventory. Did assumptions about a booming GDP throw off the birth/death model? I think so and it probably still is. (1.8+5.6+2.5)/3=3.3. That is slightly above trend growth. On the other hand if 5.6 is some sort of one time anomaly, we are near the stall rate which I propose to be around 2%.

Regardless of how one twists and turns, a huge percentage of this "recovery" was fueled by housing bubble economics. That engine of growth has stalled and will soon go into reverse. A recession looms.

Let's now turn our attention to our neighbor to the north.

Canada

It seems it was Strike Two in Canada. Bloomberg is reporting Canada Shed 5,500 Jobs in July, Unemployment Rises to 6.4%.

Aug. 4 (Bloomberg) -- Canadian employers unexpectedly shed 5,500 jobs in July, marking the first consecutive monthly declines in almost two years, strengthening the case for the Bank of Canada not to raise interest rates again this year.Safe Havens

The unemployment rate rose to 6.4 percent from 6.1 percent in June, which was the lowest since 1974, Statistics Canada said today in Ottawa. The labor force, the number of Canadians 15 and older holding or looking for a job, rose by 64,200.

Economists surveyed by Bloomberg News expected 23,500 new jobs in July and an unemployment rate of 6.1 percent, according to the median estimates of 20 and 19 economists, respectively. Canada lost 4,600 jobs in June.

The report suggests one of the most robust aspects of Canada's 15-year economic expansion may be weakening, as a strong currency slows exports and a higher benchmark interest rate make it harder for businesses and consumers to borrow and spend. The most recent StatsCan figures showed economic growth stalled in May for the first time in eight months.

Every day I receive emails from people asking "What currency should I park my money in?" It is very difficult to give generic answers to those questions. Yet Brian McAuley and I discuss issues like those in every issue of The Survival Report. July was the last issue that will be free.

As for "Safe Currency Havens" I am sure that Brian and I are on different wave lengths with the masses. The number of people recently proposing out of the blue, safe havens in the Canadian or Australian dollar is rather interesting.

There is no guaranteed trade at this time, nor will there ever be a guaranteed trade at any time in the future, regardless of what anyone thinks. But the fact that so many want to plow into the Canadian dollar near these highs should be in and of itself a warning sign.

It is easy to say the US dollar is trash. We believe it is too (ultimately). But one also has to look against what, and in what timeframe. The questions may be simple but the answers are complex. Are you looking 3 months, 6 months, 1 year, or three years into the future? Each one of those might require a different answer. We (Brian and I) hope to stay on trends like these and provide guidance, most likely of a contrarian nature.

We went long treasuries at a point where everyone despised them. When everyone starts to love treasuries (and as impossible as that may seem we think it will happen) we will be out of them. We went short the Nasdaq and are still in that trade from months ago.

By no means have we gotten everything correct. Nor do we ever expect to. Perhaps the best thing we offer is a balanced look at things. We are not permabulls or permabears but rather look on things sector by sector. If we ever are correct about everything, please stop reading us because it won't last.

Addendum:

The Fed paused today and the market seems excited about CSCO after hours.

Rest assured both are irrelevant.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/