Strike Three

Mish Moved to MishTalk.Com Click to Visit.

For the third month in a row there was a huge miss in job gains vs. expectations.

On June 7th the Bureau of Labor Statistics reported the June 2006 employment numbers.

Nonfarm payroll employment rose by 121,000 in June, and the unemployment rate was unchanged at 4.6 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Employment continued to trend upward in several service-providing industries and in mining. Average hourly earnings rose by 8 cents in June.ADP Job Estimates

Total nonfarm payroll employment increased by 121,000 in June to 135.2 million. This increase followed job gains of 112,000 in April and 92,000 in May, as revised. The average monthly gain of 108,000 over this 3-month period compares with an average monthly gain of 169,000 over the 12-month period ending in March.

Local government employment was up 24,000 in June with most of the increase in functions other than education. Employment continued to trend up over the month in food services and in wholesale trade. Financial activities had little job growth for the second month in a row.

Average hourly earnings of production or nonsupervisory workers on private nonfarm payrolls rose by 8 cents in June to $16.70, seasonally adjusted. This followed increases of 10 cents in April and 1 cent in May. Average weekly earnings increased by 0.8 percent in June to $566.13. Over the year, average hourly earnings increased by 3.9 percent and average weekly earnings increased by 4.5 percent.

Expectations headed into the report were soaring on the basis of an ADP estimate calling for a job growth of 368,000.

The ADP National Employment Report was developed to help meet the need for additional timely and accurate estimates of short-term movements in the national labor market among economists, financial professionals, and government policy-makers.In April ADP predicted 175,000 new jobs

In April the actual number was 131,000

A miss of 25%

In May ADP predicted 122,000 new jobs

In May the actual reported number was 74,000 jobs

A miss of 39%

In June ADP predicted 368,000 new jobs

In June the actual reported number was 121,000 jobs

A miss of 67%

Hmmm. Is there a pattern here?

Of course that is putting faith in government numbers which is in and of itself highly suspect.

Nonetheless, of those 121,000 jobs, 24,000 are pure waste (government jobs that probably should be eliminated). That makes the jobs growth closer to 97,000.

The Birth/Death Model

For those that have not yet heard of Birth/Death Model, it is a government estimation of jobs assumed to be created based on the birth or death of businesses (as opposed to individuals), based on where the government assumes we are in the business cycle.

The table above shows the government assumed 175,000 jobs were created in June.

If one subtracts the two numbers (121,000 - 175,000) we actually lost 54,000 jobs this month (that any one can really account for). Technically that statement is not correct because the other numbers are seasonally adjusted while the birth/death numbers are not. Of course this makes little sense but numbers from the government seldom do. What we can say for certain is there is a staggering disconnect between negative job growth and the ADP prediction of +368,000 jobs.

Birth/Death Model Notes:

- The net birth/death figures are not seasonally adjusted, and are applied to not seasonally adjusted monthly employment links to determine the final estimate.

- The most significant potential drawback to this or any model-based approach is that time series modeling assumes a predictable continuation of historical patterns and relationships and therefore is likely to have some difficulty producing reliable estimates at economic turning points or during periods when there are sudden changes in trend. BLS will continue researching alternative model-based techniques for the net birth/death component; it is likely to remain as the most problematic part of the estimation process.

-193 116 135 271 211 175 = +715

The government models are assuming 715,000 jobs were created that the government can not really account for. Maybe they exist and maybe they don't.

The actual reported numbers for 2006 are as follows:

154 200 175 112 92 121 = +854

So roughly speaking, of the 854,000 jobs created this year, 715,000 of them were assumed. That is a staggering 83.72% assumption.

Job Growth

The Economic Policy Institute is reporting Slow job growth in second quarter reflects pace of overall economy.

For the third month in a row, the nation's employers hired fewer workers than analysts expected, providing another month of evidence that the American job machine has downshifted. During the second quarter of the year, payrolls grew by 108,000 per month, well off the previous quarter's monthly rate of 176,000, and the slowest quarter since 2003Q3 (when the economy finally pulled out of the jobless recovery). According to today's report from the Bureau of Labor Statistics, the private sector added only 90,000 jobs last month—86,000 per month over the quarter—a clear sign that the economy is generating less labor demand.Given that conventional wisdom says the economy needs to create 150,000 jobs a month to keep up with the birth rate (the actual birth rate + immigration, not the BLS birth/death model we just talked about), what do you do if you are a government bureaucrat and you can not make those numbers even when you assume staggering numbers of jobs?

An important hint from today's report, for example, shows that employment in residential construction fell 6,800 over the past two months, the sector's first back-to-back monthly losses since the spring of 2001. Thus far this year, residential construction employment is up 7,000, compared to an increase of 20,000 over the same six-month period last year. And while employment in real estate was up 5,000 last month, job growth among credit intermediaries and insurance carriers—so-called "downstream industries" from the housing sector—-has been notably flat over the past few months. In other words, there are many connections between the housing sector and other sectors in the job market, and the cooling of that sector has far-reaching implications.

Retailers also shed 7,000 jobs last month, led by a large 14,000 decline in general merchandisers. Employment is down 80,000 in retail this year, reflecting a general weakening in sales in recent months, and also perhaps a decline in hiring needs due to increased Internet purchases.

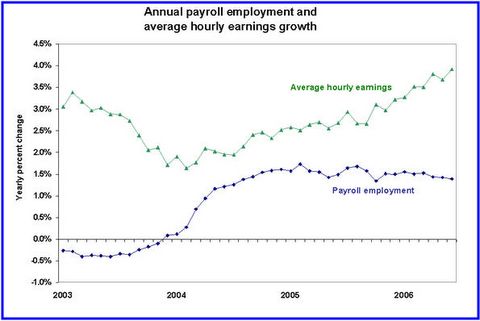

Changes in wages, on the other hand, tend to occur more gradually. That is, it takes a while—at least half of a year—for the momentum from the job market to begin to reach and effect wage trends. The chart below compares year-over-year growth rates in payroll employment to nominal hourly wages. Though employment began to accelerate in 2003, wages continued to grow more slowly until 2004, and did not accelerate much until the spring of 2005. In that regard, if the current slowdown in job growth sticks, we can expect wage growth to follow suit by declining sometime early next year.

Summarizing, June's employment report added yet another month to a trend toward slower job growth that began earlier this year. The slowdown appears rooted in the same growth-dampening forces found in the overall economy, and in that sense, this cooling is likely to persist. While wages have accelerated of late, they are only now catching up to recent inflation rates, meaning workers' purchasing power is up only slightly (and still well below productivity growth). Moreover, the inherent lags in the employment/wage relationship suggest that, if the current slowdown in job growth continues, wage growth will also slow in coming months.

Chicago Fed to the Rescue

On June 2, 2006 Chicago Fed President Michael Moskow gave a speech on U.S. Economic Outlook and the Role of Inflation Inertia. Here is the key snip:

With overall population growth continuing to slow and labor force participation not expected to rise, we probably need to adjust our benchmarks for what level of employment growth is consistent with economic growth near potential and a steady unemployment rate. It used to be that increases in payroll employment that averaged 150,000 per month were consistent with flat unemployment. Now that number may be closer to 100,000.

Quite frankly it is absurd to suggest that a falling participation rate during an economic expansion is a normal state of affairs. That is just one of the reasons the stated unemployment rate is a total fabrication of reality.

Unemployment Numbers

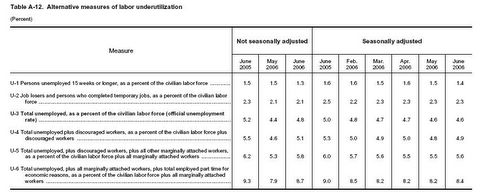

Table A12 is a closer picture of reality but that too is probably off by some 10% government fudge factor (if not a lot more) which would put unemployment close to 10%.

Notice the huge rise in both seasonally adjusted and seasonally unadjusted numbers on line U-6 (from 7.9% to 8.7% unadjusted, and from 8.2% to 8.4% adjusted). The former may have something to do with school vacations but the latter has not changed since March. The last seasonally adjusted change (February to March) was in the other direction.

Sentiment

Republican US House Representative Ron Paul is asking Why Are Americans So Angry?

I have been involved in politics for over 30 years and have never seen the American people so angry. It’s not unusual to sense a modest amount of outrage, but it seems the anger today is unusually intense and quite possibly worse than ever. It’s not easily explained, but I have some thoughts on this matter. Generally, anger and frustration among people are related to economic conditions; bread and butter issues. Yet today, according to government statistics, things are going well. We have low unemployment, low inflation, more homeowners than ever before, and abundant leisure with abundant luxuries. Even the poor have cell phones, televisions, and computers. Public school is free, and anyone can get free medical care at any emergency room in the country. Almost all taxes are paid by the top 50% of income earners. The lower 50% pay essentially no income taxes, yet general dissatisfaction and anger are commonplace. The old slogan “It’s the economy, stupid,” just doesn’t seem to explain things.Mish notes:

When people see a $600 million embassy being built in Baghdad, while funding for services here in the United States is hard to obtain, they become angry. They can’t understand why the money is being spent, especially when they are told by our government that we have no intention of remaining permanently in Iraq.

The bickering and anger will not subside soon, since victory in Iraq is not on the horizon and a change in policy is not likely either.

The neoconservative instigators of the war are angry at everyone: at the people who want to get out of Iraq; and especially at those prosecuting the war for not bombing more aggressively, sending in more troops, and expanding the war into Iran.

As our country becomes poorer due to the cost of the war, anger surely will escalate. Much of it will be justified.

It seems bizarre that it’s so unthinkable to change course if the current policy is failing. Our leaders are like a physician who makes a wrong diagnosis and prescribes the wrong medicine, but because of his ego can’t tell the patient he made a mistake. Instead he hopes the patient will get better on his own. But instead of improving, the patient gets worse from the medication wrongly prescribed. This would be abhorrent behavior in medicine, but tragically it is commonplace in politics.

If the truth is admitted, it would appear that the lives lost and the money spent have been in vain. Instead, more casualties must be sustained to prove a false premise. What a tragedy! If the truth is admitted, imagine the anger of all the families that already have suffered such a burden. That burden is softened when the families and the wounded are told their great sacrifice was worthy, and required to preserve our freedoms and our Constitution.

But no one is allowed to ask the obvious. How have the 2,500 plus deaths, and the 18,500 wounded, made us more free? What in the world does Iraq have to do with protecting our civil liberties here at home? What national security threat prompted America’s first pre-emptive war? How does our unilateral enforcement of UN resolutions enhance our freedoms?

These questions aren’t permitted. They are not politically correct. I agree that the truth hurts, and these questions are terribly hurtful to the families that have suffered so much. What a horrible thought it would be to find out the cause for which we fight is not quite so noble.

Yes Mr. Speaker, there is a lot of anger in this country. Much of it is justified; some of it is totally unnecessary and misdirected. The only thing that can lessen this anger is an informed public, a better understanding of economic principles, a rejection of foreign intervention, and a strict adherence to the constitutional rule of law. This will be difficult to achieve, but it’s not impossible and well worth the effort.

- Ron Paul is probably the only "True Conservative" in Congress.

- He is a both a fiscal conservative and has opposed this war from the beginning.

- Unlike some wishy-washy Democrats and Republicans flip-flopping depending on which way the wind was blowing, his views on this war have been consistently correct.

- It is surprising he can be elected at any level. People with common sense seldom are.

- I would vote for Ron Paul in one second flat for President.

- Sad to say, he has as much chance as I do. (close to zero)

As much as I agree with Ron Paul on the absolute stupidity of this war and the 1/2 Trillion dollars we have wasted on it (so far), I do not think that is the reason US citizens are angry. If the US economy was really booming and wages were rising in relation to costs people would feel good.

To me, Bush's 30% approval ratings (and the anger that Ron Paul sees) are a reflection on the Fed's failed attempt to reflate this economy. After three years of boom, with CEO pay skyrocketing, productivity soaring, real wages for the median worker are still falling. OK so Friday's numbers show a jump in wages at the tail end of a three year boom. That is too little, too late as we sail into the recession of 2007. If things deteriorate fast enough (a distinct possibility), that recession can start in 2006.

For many folks a recession has already started. Subtract total nonsense from the GDP and it would easily be two points lower as discussed in Grossly Distorted Procedures. Officially we will not recognize a recession until it is well underway and obvious to everyone.

Four Reasons People Are Angry

- People are angry because they majority of them are worse off than they were 4 years ago.

- People are angry because gasoline prices are rising faster than wages.

- People are angry because they are going deeper in debt and house prices have stopped rising.

- People are angry because they know deep down that they are being lied to by this administration about the CPI, about unemployment numbers, and about "the good times just around the corner" that somehow never seem to get much further than the top 15-20% of the population.

We might see a huge difference if someone like Ron Paul was in charge. At least he would lay it on straight about what is happening to the US dollar, government debt, the Fed, and a vast array of other problems as well. People need to hear his message but few do. Worse yet, most people do not even want to hear his message. They want to be told "good times are around the corner", there is a "free lunch", and other happy messages. Yet when those happy messages do not trickle down to the masses, the masses get angry. All of this makes Ron Paul unelectable (for president).

As it stands, we may as well not even have a Congress. All that matters to most of them is getting re-elected. To get re-elected they need contributions. This makes the bulk of Congress beholden to lobbyists and campaign contributions. The number of paid lobbyists is soaring and the amount they are being paid is soaring as well. Except for an isolated Ron Paul here or there, no one is looking out for the little guy. As it stands we may as well eliminate the middle man (Congress) and just elect lobbyists. They write the bills anyway.

Yes, the public is angry, but they really do not understand the root cause (fiscal irresponsibility of this administration and Congress), reckless foreign policy, and loose monetary policy by the Fed. Unfortunately there is little impetus for real change. People will elect representatives that offer a "free lunch".

The sad state of affairs is that everyone wants a "free lunch" for themselves (or their district) while insisting everyone else to pay "their fair share". As it stands, the "you scratch my back I'll scratch yours" pork barrel politics of elected officials beholden to lobbyists ensures we keep building bridges to nowhere that benefit no one but their corporate sponsors.

Yes, Ron Paul there is indeed anger but sad to say, stupid decisions like Iraq would be overlooked if there was some trickle down in benefits to the masses. There has not been that trickle down, and we are cruising for a long and hard recession led by a decline in consumer spending and housing, accompanied by mass layoffs in those sectors.

That is what Bush's numbers suggest, that is what the public senses, and that is what this anger is all about. Strike Three.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/