What is GM worth?

Mish Moved to MishTalk.Com Click to Visit.

I have been wondering what GM is worth.

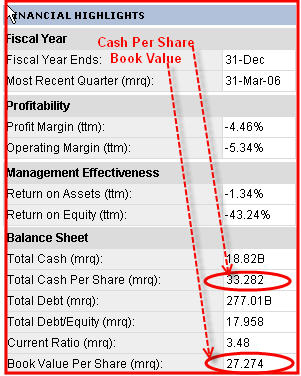

One measure is book value and that is currently sitting at $27.27.

GM is also sitting outright on $33.28 in cash per share as the following chart shows.

Aren't companies supposed to be a great buy at book value?

Perhaps, but what if book value is exaggerated?

Let's dissect GM's latest annual report and see what we can find.

Balance Sheet

Right off the bat we see that assets minus liabilities show GM to be worth approximately $15 billion. With various small adjustments the annual report shows shareholder equity to be $14.597 billion.

That is yet another possible answer for what GM is worth.

But wait a second.

What about all of those footnotes?

What do they mean?

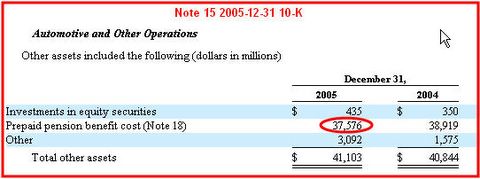

Please consider Note 15.

The above is only a portion of Note 15, but the part that is of the most interest.

The actual report has other asset categories and the total of all of them is indeed 58,086 as shown in the first chart. The figure to make note of is pension assets of 37,576.

Liabilities

Pension assets were hidden in note 15, but liabilities were hidden in note 18. Notice that GM broke this out by type of obligation and country of obligation. If you add all of those liabilities up you see that GM has whopping pension and post retirement liabilities of $69.258 billion. $60.899 billion of that is "US Other Benefits".

Wait a second. Don't the first two chart show that GM declared those liabilities to be $45.301 billion and the declared assets to be $37.576 billion? That difference is a negative $7.725 billion (45.301-37.576). Note 18 shows otherwise. The stated fair value of those assets is $125.457 billion (95.250+9.925+20.282) while the benefit obligation is $194.715 billion (89.13+20.641+81.181+3.760). The difference between $194.715 billion and $125.457 billion is $69.258 billion, yet the balance sheet only accounts for $7.725 billion of it.

If the balance sheet properly reflected the true state of its pension plan you should subtract another $61.533 billion (69.258-7.725) from shareholder equity. That calculation puts shareholder equity at roughly a NEGATIVE $46.936 billion dollars (14.597-61.533).

Enquiring minds might be asking "How much longer can GM get away with this nonsense?"

The answer it seems may not be much longer. Please consider Reforms to U.S. Pension Funding and Accounting Rules.

Serious pension underfunding is in large part due to funding targets are not based on mark-to-market measures of pension assets and liabilities. Instead, reported asset values are typically an average of past mark-to-market measures, and reported liabilities are computed using an average of the long-term interest rate over the previous four years. When long-term interest rates are declining, as they have been since 2000 until recently, reported pension liabilities understate true liabilities. In addition, plan liabilities are understated because they don't properly account for early retirement and lump-sum payout options.Obviously GM has been getting away with murder and Wall Street is far too happy to play along. As long as GM can sell billions of dollars in worthless bonds at lucrative fees and as long as there are trillions of dollars to be made betting for or against its bankruptcy, the game will continue. Right now the market says GM is worth $29.50+- so that simply must be the current arbiter of what GM is worth.

Not only do current funding rules allow funding targets to move slowly toward their correct values, they also allow measured funding shortfalls to be closed too slowly. This is especially true for funding shortfalls arising from plan amendments that raise pension benefit levels. Under current law, these shortfalls are amortized over periods as long as 30 years. Not surprisingly, many plans have taken advantage of this rule by specifying dollar pension benefit levels in the pension agreement and making frequent amendments raising benefit levels. A large share of current underfunding is attributable to such plans.

Recently FASB undertook a two-phase project reviewing its accounting guidance for pensions and post-retirement benefits. Phase 1 has resulted in a draft rule that is now open for comment. That rule dictates that reported pension liabilities take account of projected benefits as opposed to already-accrued benefits, and that pension assets and liabilities be reported on company balance sheets rather than just in footnotes as is currently the case. A final rule is expected by year-end. Phase two of the project, a joint initiative with the International Accounting Standards Board, is more ambitious and is expected to last three years or longer. That phase will consider advising that companies value pension assets and liabilities at fair market value rather than allowing them smoothing mechanisms, and that any changes in the fair market value of net pension obligations flow more directly to earnings.

Perhaps a more pertinent question for investment purposes is what GM is likely to be worth some three to five years into the future. Assets minus liabilities are a negative $47 billion and that will be impossible to make up. GM is arguably surviving right now only because of cash on hand. The latest rally in GM from roughly $18 to $29+ is explainable as well. There were simply too many people betting too heavily against GM (via put options expiring in 2007), and now they are taking those bets off realizing they were wrong. Unwinding of massive numbers of GM puts creates an underlying bid and GM rallied.

The Ecommerce Times is reporting Thousands Making Early Exit at GM, Delphi.

The nation's largest automaker said it expects to save $5 billion in structural costs in 2006, with a substantial portion coming due to the announced buyouts and retirements. Chairman and CEO Rick Wagoner said the exodus will allow GM to dramatically reduce the number of workers in the "jobs bank," where laid-off workers get most of their pay and benefits even when they're not working.A close look at the above pictures shows GM's recent buyouts to be little more than short term salary relief as opposed to doing much of anything for its long term medical and pension problems. Those pension benefits were reduced by a mere 4,600 workers. Long term it seems that GM still has severe pension/medical problem that may very well eat them alive over time.

Based on preliminary numbers from GM, about 4,600 employees accepted buyouts and about 30,400 chose to retire. It is expected that most will retire or leave the company by the end of the year, GM said.

GM offered buyouts of US$140,000 for workers with at least 10 years of service, while those with less than 10 years would receive $70,000. The workers would cut nearly all ties with the company except for vested pension benefits.

Wagoner said the exodus will allow GM to dramatically reduce the number of workers in the "jobs bank," where laid-off workers get most of their pay and benefits even when they're not working.

Mish notes:

The above analysis is a good hard looked at GM solely on the basis of pension plan assets and liabilities. I made no attempt to decide the breakup value or worth of various components such as GMAC nor is it possible to decipher the value (if any) of recently proposed synergies between GM and Renault-Nissan that CEO Wagner calls "interesting".

Still the details of this proposed alliance are sketchy and perhaps nothing more than an attempt to drive up share price temporarily rather than expectations of achieving some kind of significant lasting benefit.

Long term I fail to see how GM has significantly addressed their medical/pension problems or their cost disadvantages to other auto makers. Add in a consumer led recession and the odds of GM's long term survival are questionable at best.

GM is currently sitting on $30+ billion in cash. How long will that cash last in a severe recession? At one time Delta Air Lines was sitting on a huge pile of cash too. Eventually Delta drained all its cash reserves before filing for Chapter 11. Unless and until GM addresses its long term structural problems, it is likely to eventually follow suit.

Addendum:

No sooner than I finish the above notes do I see an article citing GM CEO WAGONER GM doesn't need a white knight.

General Motors Corp. Chairman Rick Wagoner defended his turnaround Tuesday and said the automaker isn't seeking a "white knight" to ride to its rescue.Hmmm. There are "leaks of boardroom discussions". Does that smack of some sort of power play to unseat Wagoner? If so is that a good thing, a bad thing, or a meaningless sideshow? I think the latter. Unless and until GM can eliminate its long term structural disadvantages in costs, eliminate its pension and medical liabilities, deal with falling market share, get consumers to like its cars, and survive a nasty consumer led recession in the face of rising costs of debt, board power plays are likely meaningless. GM may have taken steps to do some of the above, and may have even accomplished far more that Wall Street expected, but in the grand scheme of things it is likely a case of "too little, too late".

In his first interview since shareholder Kirk Kerkorian urged GM to consider an alliance with industry superstar Carlos Ghosn's Renault-Nissan alliance, Wagoner said GM management will study the blockbuster proposal with an open mind even as it forges ahead with the revival of its core business.

"We didn't build our turnaround plan on the basis that a white knight would come in at the 11th hour and bail us out," Wagoner told me Tuesday. "Because my experience in life is when you bet on somebody saving you, that's a pretty risky business.

For now, Wagoner isn't betraying whatever bias he may have. He says he knows Ghosn and respects him. He says GM has done alliances before, learned from the successes and the missteps -- some of them very costly in dollars and lost reputation.

He says leaks of boardroom discussions "is not constructive at all" and "it's a very unfortunate trend in recent months."

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/