Timing the Credit Event

Mish Moved to MishTalk.Com Click to Visit.

Back in September we asked: Are we headed for a "credit derivatives event"?

We pointed out what Saxon Capital was saying in an earnings conference call.

Here are the key points:

- "At the point in time WHEN the credit event comes, AND IT WILL we will be very well placed to take advantage of what happens next"

- "I am concerned about the level of capital" of our competitors "to service the bonds as those portfolios age"

- "Should real estate on the west coast flatten out I would be worried about a credit event"

(Click on any chart for an expanded view).

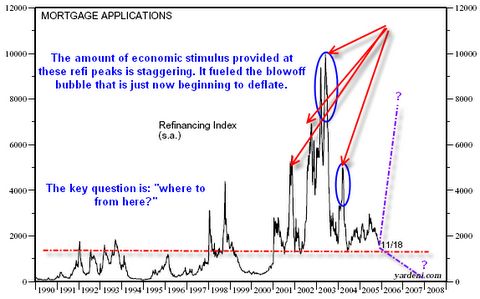

The following chart is courtesy of Yardeni, with Mish annotations.

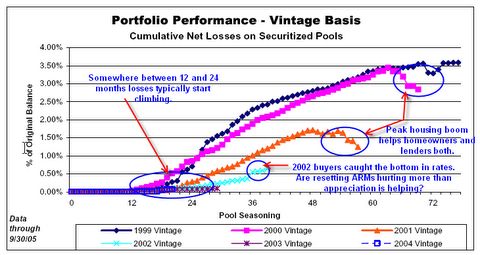

It should be clear from the above charts that a boom in refis at lower rates may have helped stall rising delinquencies and loan losses.

Also note how 2002 stands out from all other years on the second chart. For 2002 there was no dip in delinquencies or loan losses corresponding to the blowoff top in housing. Is this related to the fact that ARM loans from 2002 are now resetting? Remember too that anyone that took out an interest only loan near the lows has now suffered thru 12 consecutive rate hikes. $500 minimum monthly payments are now close to $850. Does that matter? I think so, and savings rates that have now gone negative may offer some proof.

The 2003 and 2004 loans are the ones to watch. With home prices stalling, and even declining in some key areas it may not be possible to refi even IF rates drop. In that regard a good guess is those purple question marks on the second chart resolve lower regardless of what rates do. Two more hikes and this economy is likely in deep trouble.

Back on November 15th, we looked at Bank Lending Practices .

Let's review a chart and some text from that blog.

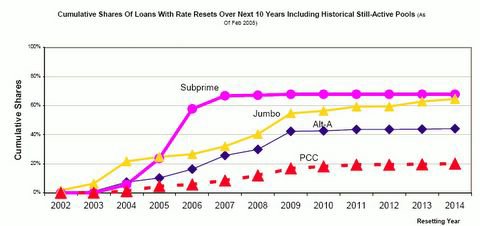

Some time within the next year 60% of all of the outstanding subprime adjustable loans are going to reset. This is going to be a rude awakening to many who will see monthly mortgage payments skyrocket. Worse yet, given rising inventories and falling or stagnant home prices it is going to be hard to sell.

Right now it does not seem to matter. That is the way it always is. Nothing matters until it matters, and the corollary is that it never matters until the bitter end. Right now it seems that the fat lady is singing but few hear the tune.

Considering all of above, it seems likely that both a credit event (spawned by collapsing housing prices) and a recession are in the cards for 2006. The more hikes the FED gets in now, the more hikes the FED will be taking back in 2007.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/