Are we headed for a "credit derivatives event"?

Mish Moved to MishTalk.Com Click to Visit.

Here is a recap of the current state of affairs.

In Are you missing the real estate boom? we noted Saxon Capital openly discussing both "credit events" and the "perfect storm" in an investor conference call. This is what Saxon Capital was saying:

- "At the point in time WHEN the credit event comes, AND IT WILL we will be very well placed to take advantage of what happens next"

- "I am concerned about the level of capital" of our competitors "to service the bonds as those portfolios age"

- "Should real estate on the west coast flatten out I would be worried about a credit event"

- There are people that will buy a 100% Loan to Value (LTV). We do not have that product we do not believe in it. We want the stated income borrower to actually have some skin in the game"

- We can now offer those products but "We have no intentions of putting those loans in our portfolio... We are going to pass them thru to other investors"

- Question: and you think that is a good strategy thinking this is The Perfect Storm you are describing?

- Answer: "As long as the market is willing to provide that credit... they attempt to deliver the customer as much cash as possible with the least amount of investigation or effort...That's what drives our customer... In order to get the customers we want we need to be able to offer those products"

- Question: "Since I have known you, you have been bearish on the industry ... now you are saying I want to be more like people offering products that are unsustainable. I am struggling with that"

- Answer: "The only difference is that I do not intend to put those in my portfolio... and the day that I can't sell these (to someone else) is the day that I stop offering them".

In Derivatives cannot take the pressure Brad DeLong comments on a Financial Times report as follows:

- "There is now about eight times the number of outstanding futures contracts as bonds eligible and available to fulfill them."

- "In June, some large holders of the June 10-year Treasury futures contract, including Pimco, demanded settlement -- taking delivery of actual bonds -- instead of, as usual, rolling their positions into the next contract. The scramble to find the necessary notes was made worse by the fact that one account, possibly the hedge fund Citadel, already held the bulk of the cheapest notes to deliver."

- "The real problem is that the US economy is just too leveraged. Starting with the housing industry, the country is too dependent on derivatives markets to create the illusion that interest rate risk can be conjured away. The technical problems of the 10-year are just another early warning sign of this fundamental weakness."

An investor has sued money manager Pacific Investment Management Company, claiming the firm manipulated the price of June 10-year Treasury futures contracts on the Chicago Board of Trade.Let's backtrack for a moment and consider a time When Genius Failed.

The suit filed in the U.S. District Court for Eastern Illinois in Chicago, which claims Pimco violated the Commodity Exchange Act, is seeking class-action status. Chiu is accusing Pimco of creating a manipulative "short squeeze," which causes short-sellers to pay inflated prices to cover their positions because the entity that owns large amounts of a given security withholds the securities from the market.

The shortage of 10-year Treasury notes led to the millions of dollars of investment losses in June, as short sellers scrambling to cover their positions had to buy back the bonds at high prices to fulfill their obligations.

Chiu's complaint charges that, during the period in question, there were only about $10 billion to $13 billion of the "cheapest to deliver" 10-year Treasury notes available to satisfy the June futures contract, while the value of these outstanding contracts was as high as $170 billion. The complaint alleges that this "artificial scarcity" of bonds caused the price of the futures contracts to increase, generating a profit for Pimco.

When Genius Failed, by Roger Lowenstein, is the detailed history of the rise and tragic fall of Long-Term Capital Management(LTCM). LTCM was a hedge fund that brought the financial world to its knees when it lost $4 billion trading exotic derivatives.What became of the LTCM founders?

Roger Lowenstein explains how Long-Term became arrogant due to its success and eventually leveraged $4 billion into $100 billion in assets. This $100 billion became collateral for $1.2 trillion in derivatives exposure!

In 1998, Russia defaulted on its bonds- many of which Long-Term owned. This default stirred up the world’s financial markets in a way that caused many additional losing trades for Long-Term.

By the spring of 1998, LTCM was losing several hundred million dollars per day. What did LTCM’s brilliant financial models say about all of this? The models recommended waiting out the storm.

By August 1998, LTCM had burned through almost all of its $4 billion in capital. At this point LTCM tried to exit its trades, but found it impossible, as traders all over the world were trying to exit as well.

With $1.2 trillion dollars at risk, the economy could have been devastated if LTCM’s losses continued to run its course. After much discussion, the Federal Reserve and Wall Street’s largest investment banks decided to rescue Long-Term. The banks ended up losing several hundred million dollars each.

They went on to start another hedge fund.

In Thoughts on Volatility we discussed the explosive use of all kinds of credit derivatives including

- Credit Default Swaps (CDS)

- Collateralized Mortgage Obligations (CMO)

- Collateralized Debt Obligations (CDO)

- synthetic CDOs

Here is a snip:

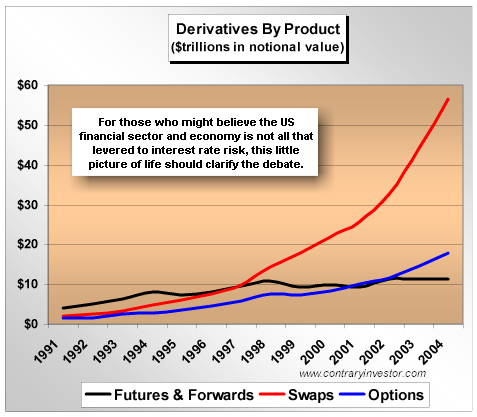

Synthetic CDOs have become hugely popular because they offer almost infinite ways for banks, insurers, hedge funds, and many other money managers to speculate on credit spreads-the spreads between different debt markets, between the debt of different issuers, between different classes of debt on a single company's balance sheet, and so on.Perhaps the following picture courtesy of Contrary Investor will help summarize the current situation.

Other innovations include swaps on first-to-default and nth-to-default baskets, swaps on credit derivative indexes, and other highly complex swaps that attempt to cover more than just default risks by combining amortization, call, and prepayment provisions into a single package.

Some CDO portfolios are combining credit swaps on bonds and loans, and others are branching into swaps on asset-backed securities backed by anything and everything from commercial and residential mortgages to aircraft leases. Rating agencies have been hard pressed to keep up with all the new wrinkles.

CDOs and synthetic CDOs are among the most complex financial instruments that you can find. They are often cut into custom tailored slices to suit the "needs" of an individual hedge fund. Obviously this complexity makes the CDO market very illiquid. Illiquid CDOs may contain illiquid CDSs as part of the structure. Given the party-to-party illiquidity of both the CDS and CDO markets with one potentially "supporting" another, it is obvious we have an enormous problem should anything go awry.

Given the "obvious benefits" of these "investments", CDOs and synthetic CDOs have sparked a boom in "credit risk transfer" as hedge funds and banks are all trying to measure and capture anomalies in the spreads between various credit instruments. Let's flashback to 1998. Attempts to exploit anomalies in credit spreads is essentially what Long-Term Capital Management (LTCM) was trying to do when it collapsed in 1998 and nearly threw the U.S. financial system into a freefall. Lenders organized by FED, just minutes before an options expirations close, bailed the fund out. The FED has always stood ready to "bail out" the most stupid investments and that of course has led to even more widespread taking of risk such as we are currently witnessing.

Of course CDO activity is far more "sophisticated" today than when LTCM blew up. Whether that is reducing the risks or creating huge new perils is a subject of much debate. Perhaps I mean the subject is debatable until some six sigma event blows it all up. Here is something to ponder in the meantime: Given the literal explosion in the use of CDOs and CDSs what will happen if something causes credit spreads suddenly to widen far more than risk models anticipate or anyone expects? I suggest the answer will not be pretty to say the least. In that regard, I sense a lull before "the big storm" and that big storm will hit in the form of a housing bust, a junk bond blowup led by GM or Ford, trade wars with China, or something completely off everyone's radar including mine. There are indeed numerous potential "tipping points" and any of them could send us over the edge.

Looking back at the Russian crisis in 1998, the default occurred in August but the credit market did not feel the full effects until October. On that basis the true consequences of mark-to-market losses from General Motors and Ford debt downgrades as well as future demand for more corporate junk may take a few months to become apparent.

Not to be an alarmist, but we are well beyond LTCM's use of derivatives that almost crushed the worldwide financial economy back in 1998. Also bear in mind that it is going to take 1500 consultants a year to straighten out FNM's derivatives alone.

Enquiring Mish readers just might be wondering about J.P. Morgan (JPM), Citycorp and other large derivative players. This article from 2002 talks about the Derivatives Monster at JPM.

Obviously bears have been talking about JPM for a long time. It has not mattered yet. Or has it? I keep wondering if those absurdly low interest rates of 1% were kept so low so long for the explicit purpose of bailing out banks like JPM and Citycorp from trillions of dollars worth of derivatives, credit instruments, and loans all gone horribly bad. I also wonder that if the FED thinks that banks are bailed out, if it now couldn't care less about cash strapped consumers.

For a more recent problem, look no further than Derivative Problems At Federal Home Loan Banks of Pittsburg.

The Federal Home Loan Bank of Pittsburgh said on Thursday it will restate over four years of financial results, mainly due to derivatives accounting errors, reducing earnings by an expected $21 million.On August 5th Randall Dodd, Director of the Financial Policy Forum wrote an interesting article on the GM debacle entitled Credit Derivatives Trigger Near System Meltdown.

Half of the 12 FHLB regional member banks are now restating earnings for similar reasons.

FHLB-Pittsburgh will restate results for 2001 through 2004 and the first quarter of 2005. The bank's review of derivatives accounting is ongoing and "could result in a material change" to its estimated earnings drop, the bank said in a statement.

Rumors started circulating two months ago concerning the possible failure of several large hedge funds and massive losses by at least one major global bank. The source of the troubles was a free-fall in prices in the credit derivatives market that was triggered by the downgrading of GM and Ford. The financial system ended up dodging a systemic meltdown, but without proper coverage and analysis of the events there will be no lessons for policy makers to learn.Is LTCM on the FED's mind once again? Given some recent near misses with derivatives, and given that no one has a clue with what might be trillions of dollars worth of derivatives at Fannie Mae, the FED should be concerned. Actually they should have been concerned long ago but typically they wait until there is a big problem and then and only then do they think about addressing it. At any rate, I am sure LTCM and a derivatives blowup is on the FED's mind since the FED issued a Summons to 14 Banks to Discuss Credit-Derivatives Controls.

This Special Policy Brief is an attempt to put these rumors together in order to tell a coherent story. The purpose is to show how the events posed a severe threat to the stability of our financial markets and overall economy. The narrative also should help illustrate the market problems with these non-transparent markets organized around dealers with no commitment to market participants to maintain orderly and liquid markets.

....

....

What is the extent of the fallout? Exact amounts cannot be known with any clarity or certainty. Actual losses at hedge funds and proprietary trading desks are not reported or at least not reported separately. The change in credit derivatives prices can be estimated from the iTraxx index for credit derivatives, however there is no reported information on the volume of trades and value of derivative and cash positions. Thus estimates of gains and losses to individual firms and the market cannot be determined.

Some anecdotal information can be gleaned from announced hedge fund closings. The well-known Marin Capital hedge fund closed doors after big losses in convertible arbitrage and credit arbitrage; and Aman Capital also closed shop at the end of the mid-year. GLG’s Neutral Group, which has credit derivative investments similar to that of Marin Capital, lost $2.5 billion or 17.2% in the first half of the year. Cheyne Capital’s hedge fund lost 4.8% in May alone. The huge hedge fund Bailey Coates Cromwell Fund, after being named Hedge Fund of the Year for 2004, announced in early June that it would close down.

The Federal Reserve Bank of New York invited 14 of the 'major participants' in the credit-derivatives market to a meeting next month amid concern the $8.4 trillion industry is rife with unconfirmed trades.Of course the FED summons brings to mind some additional questions:

The credit-derivatives market more than doubled in the past year, giving companies, investors and governments the ability to bet on or protect against changes in credit quality.

JP Morgan Chase & Co., Deutsche Bank AG, Goldman Sachs Group Inc., Morgan Stanley and Merrill Lynch & Co. dominate the credit- derivatives market as the five most-cited trading partners, according to Fitch Ratings.

The Fed's letter said 'a senior business representative and a senior risk management person,' should attend the meeting.

- Was this an "invite" from the FED or a demand to be there?

- Why is the industry "rife with unconfirmed trades"?

- If there are problems and lawsuits over treasuries, the most liquid of all futures, what the heck is going on with CDOs, CMOs, and synthetic CDOs?

- If it takes 1500 consultants a year to straighten out Fannie Mae's hedge book, how long would a complete audit of JPM's book take?

- If all JPM's trades had to be unwound tomorrow, would JPM even be solvent?

Let's now return to the original question:

Are we headed for a "credit derivatives event"?

I do not see how we can possibly avoid one, but timing it is the problem since no one knows what event might trigger the cascade.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/