Thoughts on Savings (part 2 of 2)

Mish Moved to MishTalk.Com Click to Visit.

Following is part two in a two part discussion about savings. This part will take a look at Ben Bernanke's viewpoint that there is a glut of savings and the problem is not that the US is spending too little but the rest of the world is not consuming enough. This part will also take a look at the growing national debt, the impact of Katrina, and offer some final comments of the cash flow of consumers. Here goes:

Is the problem that the US is spending too much or is the problem that the rest of the world is saving too much? Let's briefly consider the latter viewpoint. Ben "Helicopter Drop" Bernanke (affectionately known as $Ben for the rest of this article) suggests the problem with the US current account balance and growing indebtedness is a Global Saving Glut.

$Ben asks "Why is the United States, with the world's largest economy, borrowing heavily on international capital markets--rather than lending, as would seem more natural?"

In a self serving answer $Ben proposes:

"My answers will be somewhat unconventional in that I will take issue with the common view that the recent deterioration in the U.S. current account primarily reflects economic policies and other economic developments within the United States itself. To be more specific, I will argue that over the past decade a combination of diverse forces has created a significant increase in the global supply of saving--a global saving glut--which helps to explain both the increase in the U.S. current account deficit and the relatively low level of long-term real interest rates in the world today."

"One well-understood source of the saving glut is the strong saving motive of rich countries with aging populations, which must make provision for an impending sharp increase in the number of retirees relative to the number of workers. With slowly growing or declining workforces, as well as high capital-labor ratios, many advanced economies outside the United States also face an apparent dearth of domestic investment opportunities. As a consequence of high desired saving and the low prospective returns to domestic investment, the mature industrial economies as a group seek to run current account surpluses and thus to lend abroad."

$Ben proposes this solution:

"Some of the key reasons for the large U.S. current account deficit are external to the United States, implying that purely inward-looking policies are unlikely to resolve this issue. Thus a more direct approach is to help and encourage developing countries to re-enter international capital markets in their more natural role as borrowers, rather than as lenders."

$Ben concludes with:

"We probably have little choice except to be patient as we work to create the conditions in which a greater share of global saving can be redirected away from the United States and toward the rest of the world--particularly the developing nations."

Gee.

The answer to our dilemma is not for the US which has negative savings rate, consumes 25% of the world's oil supply, and goes deeper in hock every day to start consuming less, but for the rest of the world to start consuming more.

If deficit spending was the answer I am sure that many countries in Africa should by now be the most prosperous nations on earth. Besides, someone please tell me exactly what the US makes that anyone wants to buy. About the only thing I can figure out that we make that anyone wants is weapons. Yep, we make the worlds best. Unfortunately (or fortunately depending on your point of view), we will not sell those to China or many other countries in fact. Instead, China will end up buying weapons from France or Russia. Our agricultural exports depend on subsidies, and GM and Ford cars are a joke compared to cars from Japan and now South Korea. Besides, most of the parts and components in autos are not "made" in the US anyway. For the most part, all we do is assemble stuff here. If I am not mistaken, weapons really are made here.

No, $Ben the problem is NOT a global savings glut but a hollowed out US manufacturing base, bloated auto industries, refusal to sell the only really good products we make (weapons), and consumers willing to buy million dollar homes at zero % down ultimately financed by someone from Japan or China.

The prevailing line of thinking in this mess is that we are being financed by the "kindness of foreigners". Is that line of thinking correct? Perhaps we are being financed by the "cleverness of foreigners" who are willing to save while we spend ourselves into oblivion. I liken this to the fable of The ant the grasshopper.

In a field one summer's day a Grasshopper was hopping about, chirping and singing to its heart's content. An Ant passed by, bearing along with great toil an ear of corn he was taking to the nest.

"Why not come and chat with me," said the Grasshopper, "instead of working so hard?"

"I am helping to lay up food for the winter," said the Ant, "and recommend you to do the same."

"Why bother about winter?" said the Grasshopper; "we have plenty of food right now."

But the Ant went on its way and continued its work.

When the winter came the Grasshopper had no food and found itself dying of hunger, while it saw the ants distributing, every day, corn from the stores they had collected in the summer.

Then the Grasshopper knew:

It is best to prepare for the days of necessity.

Fables aside, let's now take a look at the reality of US government spending.

Following is the growth rate of the national debt limit:

In 2002 it was $450 billion.

In 2003 it was $984 billion.

In 2004 it was $800 billion.

In 2005 the House has passed an increase of another $781 billion, on which the Senate has yet to act.

Total that up and you get a stunning $3015 billion ($3.015 trillion) in additional debt in just four years. Not only do we have a negative person savings rate, but we also have Republicans spending like drunken fools, over $3 trillion was added to the national debt in a mere four years, a sitting president has not vetoed any spending bill (or any other bill for that matter during his entire term), and $Ben Bernanke suggests the problem is not with the US but rather the rest of the world is saving to much! That brilliant thinking is coming from the man who is the leading candidate to replace Greenspan as our next FED Chairman.

David S. Broder discusses the growing national debt and more in a Washington Post article entitled A Price To Be Paid For Folly. Here is a snip:

In August, when the Congressional Budget Office lowered the deficit forecast to $331 billion, Republican Rep. Jim Nussle of Iowa, the chairman of the House Budget Committee, said, "We're clearly on the right track.

These judgments were faulty at the time. They made no provision for the continuing costs of the war in Iraq, or for the Republican plan to end the estate tax and make all the previous Bush tax cuts permanent. And, most of all, they did not realistically calculate the costs of the new Medicare prescription drug benefit and the looming obligations to the millions of baby boomers who are nearing retirement age.

Now those pre-Katrina estimates have been rendered even more ridiculous. In the first 10 days since the storm hit, the president asked Congress for emergency appropriations of $62 billion -- and the bills are just starting to come in.

Treasury Secretary John Snow reportedly told congressional Republicans in a closed meeting that Katrina strengthens the case for making the Bush tax cuts permanent.

The warning signs of impending economic calamity are every bit as evident as the forecasts of ruin for New Orleans when a major hurricane hit.

The runaway budget deficits are compounded by the persistent and growing imbalance in our trade accounts -- jeopardizing the inflow of foreign funds we have used to finance our debt.

At a private dinner the other evening where many of the men and women who have steered economic and fiscal policy during the past two decades were expressing their alarm about this situation, one speaker summarized the feelings of the group:

"I think it's 1925," he said, "and we're headed for 1929."

Apparently Snowjob thinks the more money the Government gives away the more taxes should be reduced. Other than Ron Paul, is there a fiscal conservative left to be found anywhere?

There is one good thing that just might come from Katrina. My hopes are not all that high actually given the total recklessness of this Congress and this administration, but perhaps Katrina may force someone to decide whether or not to keep wasting money in that bottomless pit known as Iraq vs. wasting money in the US with insurance handouts to companies that neither need handouts or deserve them. At least in the latter case it is robbing Peter to pay Paul. The former is just blatantly throwing money into an external sink hole.

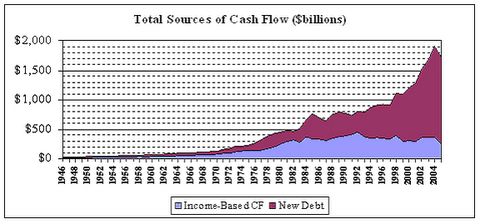

On that note, let's return for a final look at the consumer side of the savings problem. Following is a nice graph of consumer cash flows by Stephen Church as presented Prudent Bear. Let's take a look and see what Stephen Church has to say as well.

Church writes:

The analysis of the sources and uses of consumer cash flow shows that new household debt has become the main source of new cash for financing consumer uses of cash.Thanks Stephen for an excellent chart and commentary. Given that one can not perpetually refinance one's house to support consumption something clearly has to give. What has to give actually is the US standard of living. Regardless of what anyone might think, we simply can not sustain ourselves by borrowing to support consumption based on the concept of ever rising home prices. Somehow Wall Street has not caught on to this simple concept or if it has it just wants one hell of a last party before things crash.

Cash flow generated by consumer income producing activities is not sufficient to cover required debt repayments. Consumers must borrow new funds, in aggregate, in order to meet debt repayments and to make personal and residential investments.

An analysis of the uses of cash flow indicates that even the most minimal investment, residential construction, debt repayment and consumer liquidity requirements will lead to new borrowings totaling about 11% to 12% of GDP.

A scenario analysis of these financing requirements did not indicate any obvious short-term way to reduce this level of debt financing without effecting economic activity. The scenario analyses indicate that reductions in consumer liquidity would be the only reasonable path by which the economy could begin adjusting these financing needs.

It is not clear that even reducing consumer liquidity would be sufficient to support the process of slowing debt accumulation. It appears more likely that any attempt to reduce the growth of debt could result in an underperforming economy.

The scenario analysis left open a tantalizing opportunity to manage the transition to a stable economy with lower annual debt financing. The rate of growth of personal consumption expenditures would need to decline significantly while the rate of growth of personal income stayed near its current level.

The only way that we can envision this would be a managed deflation transferring corporate profits to households through price reductions on goods and services. Though this would lower profits appreciably, it would also enable the economy to cut household debt financing needs to reasonable levels.

Other than our tantalizing possibility, we were unable to identify any reasonable path of reducing the growth of household debt. The sources and uses of cash flow indicate that households are completely dependent on access to new debt.

The transition that Church envisions (a transfer of wealth via declining prices on goods and services) sure will not be a smooth or an easy one. It will also be resisted. There certainly will not be a voluntary redistribution of wealth from creditors to debtors. Given that resistance, a slow deflationary torture like Japan endured would appear to be a more likely possibility than a sudden massive purge of debts via bankruptcies. The new bankruptcy reform act (designed to make people debt slaves forever) reinforces that concept. Given that hyperinflation would "end the game" I do not believe that is a realistic possibility.

Regardless of the actual endgame or the timing of it, what we do know is that negative or even 0% savings are not sustainable, nor is the balance of trade, and nor is US government spending. Something will give. That something is some combination of a lower standard of living, a higher savings rate, a falling US dollar, and lower equity prices. My guess is we see all of those. The timing could hardly be worse as baby boomers face an upcoming retirement in mass. Those that are not prepared for such a brutal combination of possibilities are likely to be in for one rude awakening.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/