Bidding Wars Stop; Millennials Leave Their Parents' Basements, But Not For Homes; Pent Up Demand?

Mish Moved to MishTalk.Com Click to Visit.

Bidding Wars Stop

With cash-paying investors on full retreat, existing home sales dropped 1.8% in August, according to the National Association of Realtors.

Lawrence Yun, NAR chief economist says that's a good thing because "first-time buyers have a better chance of purchasing a home now that bidding wars are receding and supply constraints have significantly eased in many parts of the country.”

While I agree it's a good thing that bidding wars stopped, the fact of the matter is home prices are once again in la-la land, especially for cash-strapped millennials loaded up with student debt, in low-paying jobs.

Pent Up Demand?

Yun states, "As long as solid job growth continues, wages should eventually pick up to steadily improve purchasing power and help fully release the pent-up demand for buying.”

There is arguably a pent-up demand for homes by millennials if wages do catch up, but that assumes millennials have the same value-set and attitudes towards debt as their parents.

In reality, median wages have not gone up much but home prices have. More importantly, attitudes of millennials are not the same as that of their boomer parents.

Millennials Leave Their Parents' Basements, But Not For Homes

Fortune reports Millennials Finally Leave Their Parents' Basements.

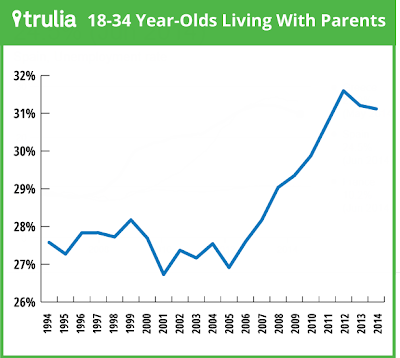

Jed Kolko, chief economist at Trulia, put together this graph, which shows that Millennials are finally moving out of their parents’ houses, after years of living at home:Census Data

But that’s where the good news ends. Over the past two years, Millennials have been moving away from home, but they don’t actually have enough money, or desire, to form their own households. The homeownership rate among Millennials continues to fall:

The falling homeownership rate and falling “headship rate”—which is the share of Millennials who are the head of a household regardless of whether they own real estate—suggest that this generation is still doubling up with friends or other relatives even if they aren’t living with Mom and Dad.

The one bright spot in the Census data for the youngest workers: between 2012 and 2013, median income for those aged 15 to 24 shot up by 10% from $31,000 per year to roughly $34,000 per year. But this is the first time since 2006 that this age group has seen any increase in income at all, meanwhile the cost of shelter has risen 16% since that time. Income for the older half of the Millennial generation rose just 1.1% between 2012 and 2013.

This poor performance could mean that the housing industry is building too many homes, according to Kolka. This is quite the surprise given that single-family housing construction is still well below pre-crisis and even pre-bubble norms.

I commend Fortune for linking to the actual data. Few mainstream media articles do.

For those who wish to take a closer look: Income and Poverty in the United States: 2013, Issued September 2014. Here are a couple of charts and stats that caught my eye.

Real Median Income

Full-Time Employment

Real Medium Income Notes

- Real median household income for those 15-24 shot up by 10.5% but only from $31,049 to $34,311. That's not enough to support buying a nice house in most areas. Moreover, the 15-24 demographic has 6.3 million households and typically that age group does not buy houses anyway.

- Real median household income for those 25-34 (about 20 million households) was only up 1.1% to $52,702. Home prices rose more, making homes less affordable.

- Real median household income for those 35-44 (about 21 million households) was only op 0.7%, but to a better looking to $64,973.

- Those aged 45-54 and 55-64 actually saw incomes declines of 0.3% and 3.3% respectively on household populations over 23 million each.

Attitudes, Wages, Home Prices

That data is from 2013, but it's very safe to conclude nothing much changed in 2014. None of the income data is supportive of more household formation. Wages have not kept up with home prices in the key demographic groups. Things are far worse if you factor in attitudes.

Attitudes - Fed's Biggest, Most Futile Fight

I have been talking about attitudes for years. For example, please consider Please consider Teenagers Scared Over Plight of their Parents; Attitudes - Bernanke's Biggest, Most Futile Fight

That 2010 post contains an email from "Nancy Drew" about her daughters, aged 15 and 17 with their friends scared half-to-death about their parents' financial woes.

Such memories last a long time.

I wrote then and I repeat now ... "Those fretting over base money supply and foolishly screaming hyperinflation (or even inflation), simply do not understand the dynamics of debt deflation, nor do they understand how small the increase in base money is compared to debt that will be written off, nor do they understand the role of changing social attitudes towards spending."

Clash of Generations

On May 30, 2014 I wrote Clash of Generations - Boomers vs. Millennials: Attitude Change Will Disrupt Wall Street and Corporate America

If you haven't read that, please do. And if you have, I suggest it's well worth another look.

Pent Up Demand to Sell

Yun thinks another housing boom is just around the corner. He talks of a pent-up demand to buy.

I suggest there's a pent-up demand to sell for three reasons:

- Aging boomers seeking to downsize

- All-cash equity buyers looking to take profits

- Some of those who were underwater and hoping to get out will do so if and when they get a chance

Will millennials be able to plug all of that pent-up selling pressure? I think not.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com