Treasury Yields Decline in Spite of Price Inflation; Mortgage Rates vs. Treasuries

Mish Moved to MishTalk.Com Click to Visit.

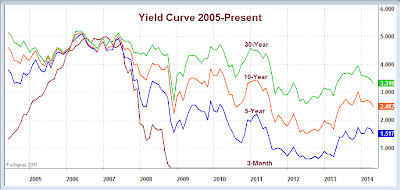

Curve Watcher's Anonymous has its eye on the US treasury yield curve today.

click on chart for sharper image

Chart Symbols

- $TYX: 30-Year

- $TNX: 10-Year

- $FVX: 05-Year

- $IRX: 03-Month

Yields Decline Today

The above table of US Bond Yield changes from Bloomberg.

CPI Up - Treasury Yields Down

With the CPI up more than expected, and with food inflation averaging 3% annually over the last three months (see Food Prices Soar; CPI Posts Biggest Gain in 10 Months; Real Average Earnings Decline) one might have expected yields to rise.

Instead, yields fell. Why?

The US economy is slowing more than expected. Lately, economic surprises have been to the downside.

Mortgage Rates at 11-Month Low

Bloomberg reports Mortgage Rates Dropping With Bond Yields at 11-Month Low

A rally in the mortgage-bond market may send U.S. home-loan rates to the lowest in almost a year, bolstering a slowing real-estate recovery.Divergence Between Mortgage Rates and Treasuries

Yields on Fannie Mae securities that guide borrowing costs because they’re used to package new 30-year mortgages for sale fell 0.04 percentage point today to about 3.16 percent as of 1:50 p.m. in New York, according to a Bloomberg index. That would be the lowest closing level since yields reached a four-month low of 3.15 percent on Oct. 29, after they surged to as high as 3.81 percent in September.

The average rate offered on typical 30-year mortgages fell to a six-month low of 4.2 percent this week from a 2013 high of 4.58 percent in August, according to Freddie Mac surveys. Borrowing costs, which are driven by changes in lenders’ profit margins as well as bond yields, are up from a record low 3.31 percent in November 2012

There can be leads and lags in mortgages vs. treasuries but generally they are in close sync.

30-year Mortgage Rate

Chart courtesy of Bankrate.

With home prices up and mortgage yields not dropping, home affordability is declining. Sales will follow. Expect household formation to stay in the gutter.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com