Wall Street Journal Questions Bernanke's Credibility and Political Will

Mish Moved to MishTalk.Com Click to Visit.

Last week, Economist Steve Keen made "The Case Against Bernanke".

Specifically, Keen says "Bernanke's ignorance of the factors that really caused the Great Depression is a major reason why the Global Financial Crisis occurred in the first place."

On Monday, I was delighted to see the Wall Street Journal make a different case against Bernanke. Please consider The Bernanke Nomination

Majority Leader Harry Reid declared his support for Mr. Bernanke on Friday, but not before extracting what he said were concessions about future Fed policy.That is a pretty damning appraisal of Bernanke's credibility. However, the journal forgot to mention Bernanke's incompetence, love of mathematical formulas, and ridiculous adherence to inflation expectation theory, while ignoring credit and housing bubbles that grandma Millie could see.

The Fed chief promised, said Mr. Reid, that he would "redouble his efforts" to make credit available and that Mr. Bernanke "has assured me that he will soon outline plans for making that happen, and I eagerly await them."

Redouble? The Fed has already kept interest rates at near zero for more than a year, and it is buying $1.25 trillion in mortgage-backed securities to refloat the housing bubble, among other interventions into fiscal policy and credit allocation. Is the Fed going to buy another $1.25 trillion, or promise to keep rates at zero for another 14 months?

Our own view is that Mr. Bernanke is already far too susceptible to political pressure. As a Fed governor, he was Alan Greenspan's intellectual co-pilot last decade when their easy money policies created the housing mania. When Congress later put political pressure on the Fed to direct credit toward housing, and even to student loans, Mr. Bernanke (who was then chairman) also quickly obliged.

More ominously for the next four years, Mr. Bernanke continues to deny any Fed monetary culpability for creating the mania. Shortly after the New Year, even with his nomination pending, Mr. Bernanke issued an apologia that was striking for its willingness to play to the Congressional theory of the meltdown by blaming bankers and lax regulators.

Yes, much of Wall Street wants to see Mr. Bernanke confirmed. The Street is currently making a bundle off Fed policy, as it borrows at near-zero rates and lends long, and the banks don't want that to end. The banks also loved negative real interest rates in the middle of the last decade, and we know how that turned out. Wall Street always loves easy money—until inflation returns, or the bubbles pop.

The next Fed chairman is going to need the market credibility, and the political support, to raise interest rates when much of Congress and Wall Street will be telling him to stay at zero. That is the real reason to oppose a second term for Chairman Bernanke.

Most galling of all is Bernanke's self serving attempt to blame everyone but himself. For details please see Ben Bernanke Looks In Mirror, Sees Barney Frank.

Geithner Attempts A Rescue

Tim Geithner has no credibility left either (not that he ever had any in the first place), but that is not stopping Geithner from protecting his cohort in crime, Ben Bernanke.

Please consider Geithner: Rejecting Bernanke Would Have "Very Troubling" Consequences.

Treasury Secretary Timothy Geithner is warning that a Senate rejection of Federal Reserve Chairman Ben Bernanke's nomination for a second term would lead to "very troubling" reaction from the financial markets.So dear Timothy, are we supposed to appoint Fed chairmen on the basis of whether or not Wall Street Approves? That has worked out well, now hasn't it?

Geithner, in the interview with Politico, said he understood why Bernanke was having a tough time, saying that the country is "in a moment where people are incredibly angry and frustrated by the damage this crisis caused."

"That's perfectly understandable, and everybody involved in this effort is bearing a lot of the brunt of that frustration and anger," he said.

Here's the deal Timothy: Bernanke is taking the heat because he followed the ridiculous policies of Greenspan, is clueless about what caused the great depression, could not see a housing bubble until it bit him in the ass three times, denied a recession was in the works, has unconstitutionally usurped authority in his bailout schemes, has selective memory, and finally, Bernanke the gall to deny his and the Fed's role in this mess.

Of course .... that's exactly why Wall Street thinks Bernanke is perfect for the job.

Fat Lady Has Not Yet Sung

While Geithner, Obama, and the Fed apologists are squawking it's all over, the math suggests otherwise.

Yves at Naked Capitalism has the details in Tell Senate “No” on Bernanke Cloture

The Bernanke vote is a powerful way to send a message to the Administration that the public is NOT buying what they are selling on the financial front, and much more fundamental change is needed.Called Already? So What? Call Again!

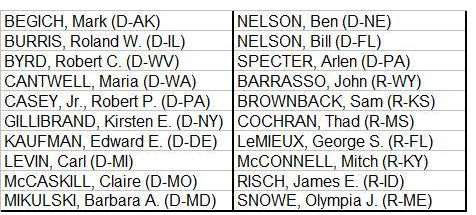

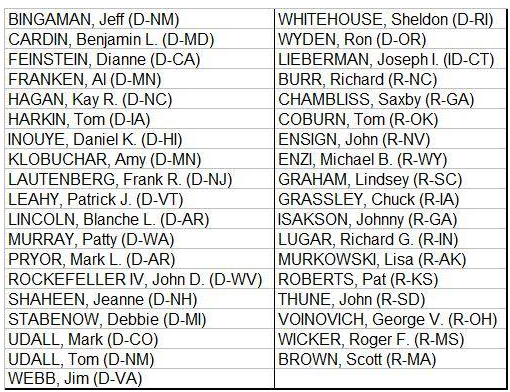

Jim Bianco made a tally Sunday afternoon and this was his bottom line: Bernanke’s reappointment vote is coming down to the wire, it is going to be close.Senators who have said they are undecided:

Senators who have not taken a stand on Bernanke:

Unlike health care or bankers’ bonuses, the Fed is not considered to be of much interest to the average voter. So evidence of voter disapproval on a matter that would normally be off the popular radar screen will send a potent message that the public is engaged, is following the politics blow by blow, and is no longer easily snookered.

Time to quit complaining and take action. Make a difference.

Send an email too!

Meanwhile I repeat what Yves said on Sunday afternoon: "You need to tell readers to vote "no" on cloture for Bernanke, not just "no" on Bernanke."

Cloture is a vote to end the discussion. It takes 60 votes to do that. It only takes 51 votes to appoint Bernanke. He likely has those 51 votes. Does he have 60? I don't know. But let's make it very difficult.

Dump Bernanke - How You Can Help!

Please review Dump Bernanke - How You Can Help! Even if you already called or emailed, do it again.

This time flood the senator's email inboxes as well. Jam em. And do it Monday, Tuesday, and Wednesday.

Maybe the votes are there. Maybe they aren't.

It's important to make sure that if the vote's are not there, it stays that way. You can help. Keep the pressure on.

Call and email your senators with the same message.

I had someone email me over the weekend that his senator's email box was filled up. The goal is to fill up the email boxes of all the senators.

Here is a directory sorted by state of all the Senators of the 111th Congress.

You can also look up the phone numbers in the Online Directory For The 111th Congress but the first link may be easier to use for just senators.

What To Say: Make it simple so as to not tie up the lines ... "Vote no on cloture to end debate on Bernanke. I am opposed to the reappointment of Bernanke [give your personal reason]. Anything to stop Bernanke including a fillibuster is fine by me."

That part in red is crucial. Specifically say "Vote No on Cloture".

Concentrate on the senate. The house has no say on this.

Be prepared to name your city and give a zipcode. Here is the Zip-Code Database.

Call and email your senators with the same message.

Here is a directory sorted by state of all the Senators of the 111th Congress.

You can also look up the phone numbers in the Online Directory For The 111th Congress but the first link may be easier to use for just senators.

Send A Message

Remember it takes 60 votes to end the debate on Bernanke, but once an actual vote is called. it only takes 51 for confirmation. If they postpone a vote on Wednesday, Bernanke does not have the votes.

Keep The Pressure On. Call and Email Now!

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List