Collapse Of The "Ownership Society"

Mish Moved to MishTalk.Com Click to Visit.

Bush's "ownership society" has collapsed under the dead weight of debt. There is too much debt and too little income to support it. Please consider President shifts focus to renting, not owning.

The Obama administration, in a major shift on housing policy, is abandoning George W. Bush’s vision of creating an “ownership society’’ and instead plans to pump $4.25 billion of economic stimulus money into creating tens of thousands of federally subsidized rental units in American cities.Barney Frank The Hypocrite

The idea is to pay for the construction of low-rise rental apartment buildings and town houses, as well as the purchase of foreclosed homes that can be refurbished and rented to low- and moderate-income families at affordable rates.

Analysts say the approach takes a wrecking ball to Bush’s heavy emphasis on encouraging homeownership as a way to create national wealth and provide upward mobility for low- and working-class families, especially minorities. Housing and Urban Development Secretary Shaun Donovan’s recalibration of federal housing policy, they said, shows that the Obama White House has acknowledged that not everyone can or should own a home.

In addition to an ideological shift, the move is a practical response to skyrocketing foreclosure rates, tight credit, and the economic crisis.

"I’ve always said the American dream should be a home - not homeownership," said Representative Barney Frank, chairman of the House Financial Services Committee and one of the earliest critics of the Bush administration’s push to put mortgages in the hands of low- and moderate-income people.

What a distortion of reality. Barney Frank was in the pocket of Fannie Mae and Freddie make and their biggest supporter for years. Now he plays on semantics in an unbelievable lie. He would have been better off keeping his mouth shut, but political hacks seldom if ever can.

It's Better To Rent

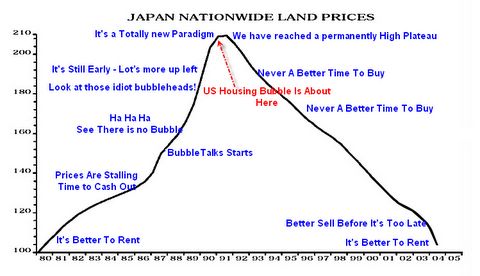

The "Rentership Society" as Calculated Risk dubs it, reminds me of a chart I put together way back in Spring of 2005. Note the lower right hand corner of the top chart.

San Diego Home Prices (with thanks to piggington)

The above charts are from It's a Totally New Paradigm written March 26, 2005. Here are some excerpts from that post.

- Ron Shuffield, president of Esslinger-Wooten-Maxwell Realtors says that "South Florida is working off of a totally new economic model than any of us have ever experienced in the past." He predicts that a limited supply of land coupled with demand from baby boomers and foreigners will prolong the boom indefinitely.

- "I just don't think we have what it takes to prick the bubble," said Diane C. Swonk, chief economist at Mesirow Financial in Chicago, who was an optimist during the 90's. "I don't think prices are going to fall, and I don't think they're even going to be flat."

- Gregory J. Heym, the chief economist at Brown Harris Stevens, is not sold on the inevitability of a downturn. He bases his confidence in the market on things like continuing low mortgage rates, high Wall Street bonuses and the tax benefits of home ownership. "It is a new paradigm" he said.

Flash Forward: July 13, 2009

Housing Update - How Far To The Bottom?

Please consider Housing Update - How Far To The Bottom? for a current look at where home prices are.

Using the Japan Nationwide Land Prices model as my guide, here is how I have called things in real time.The formation of the "Rentership Society" shows just how much things have changed. However the idea is not pervasive yet. Sentiment still has a ways to go to reach the bottom. However, I may soon need to move the arrow another notch.

click on chart for sharper image

My previous update was was on December 1 ,2008 in a post with the same name as this one Housing Update - How Far To The Bottom?

I just added the Summer 2009 arrow. Housing prices are now one notch closer to their final destination. The US Timeline scale is compressed. At the current pace, housing will take about 7 years total to bottom vs. 14 years in Japan.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List