Top 10 Bird Sounds

Mish Moved to MishTalk.Com Click to Visit.

In Canaries at the Periphery we discussed the plunging stock markets in the Mideast, the Icelandic Krona and the New Zealand dollar. The latter two currencies were blowups in the carry trade. Today the canaries are chirping closer to home. Not only that but the geese are honking and the turkeys are gobbling. Let's take a look at some of these birds, starting off with a few canaries.

The Boston Herald is reporting Ameriquest’s owner lays off 3,800.

The parent company of Ameriquest Mortgage Co. and Town and Country Credit laid off 3,800 workers nationally at retail mortgage subsidiaries and closed 229 branch offices yesterday. It has 10 Massachusetts branches.The New York Post wrote about Ameriquest's Ambassador of Doom

Orange, Calif.-based ACC Capital Holdings said it’s centralizing the operations into regional mortgage production centers in California, Arizona, Illinois and Connecticut and consolidating corporate functions at its headquarters.

The announcement follows a $325 million January settlement between 49 states, including Massachusetts, and Ameriquest, the nation’s top subprime lender. The states alleged that Ameriquest used predatory lending practices.

ACC Capital would not disclose how many Massachusetts workers lost their jobs yesterday.

“Ameriquest failed to give state regulatory authorities advance notice of its branch closures and has yet to file a closure application with the Division of Banks, which is required under state law,” state Attorney General Tom Reilly said in a statement yesterday.

Ameriquest was hit earlier this year with charges by 49 state attorneys general that his company used bait-and-switch schemes to cheat customers into taking out more costly loans.The only thing that I can see holding up his ambassadorship is his less than perfect track record. Only 49 out of 50 states filed suit againt his bait and switch lending tactics. Had it been a perfect 50 for 50 I am sure it would all be smooth sailing. Otherwise, Lord knows he fits right in with this administration.

Billionaire Roland Arnall, who built Ameriquest into the largest mortgage lender for poor credit risks, is shutting down most of his company to focus on being the new U.S. ambassador to the Netherlands.

The embattled firm yesterday said it's closing 229 branch offices, firing 3,800 mortgage staffers, and consolidating into just five call centers.

SmartMoney is reporting Hovnanian Warning Spells Trouble for Builders.

The Red Bank, N.J., builder said it will fall short of Wall Street's expectations in its fiscal second quarter as it now expects earnings in the range of $1.40 to $1.50 a share for the second quarter that ended April 30. Thomson First Call had pegged the company's earnings at $1.68 a share.Both Centex and Hovnarian are reporting falling land prices.

The builder also slashed its fiscal-2006 projection to a range of $7.20 to $7.40 a share, from previous guidance of $8.05 to $8.40 a share.

Hovnanian cited a surge in cancellation rates, a slowdown in demand, delays in certain deliveries, building-material price increases and heavier use of incentives and discounts for the weaker earnings outlook.

In another sign that the housing market is pulling back faster than expected, Hovnanian became the second major builder to take write downs in connection with land. Last week, rival Centex Corp. (CTX) took a charge of 14 cents a share in connection with the write down of certain option deposits and land parcels in Washington, D.C., Sacramento and San Diego. The write downs sent up red flags for investors, who worried this was a sign that land values were sharply deteriorating, which could mean the housing market was falling fast.

Hovnanian said it plans to take $5 million of write offs in connection with option deposits related to land.

"Although we have not needed to use this tactic as much in recent years, we have employed it successfully in prior slowdowns," Hovnanian said.

When did they start making land? I must have missed the announcement.

I have two questions for Hovnarian:

- Why is writing off land prices considered a "successful tactic"?

- How much more of these kinds of successful tactics are you going to employ?

It seems that Hov along with all other homebuilders with the exception of William Lyon Homes (WLS) have fallen on hard times. William Lyon has lost his mind and is attempting to take the company private at ever escalating price offers.

St. Joe is a real estate operating company based out of Florida that develops towns, resorts, commercial, and industrial properties in the United States. St. Joe also engages in land sales.

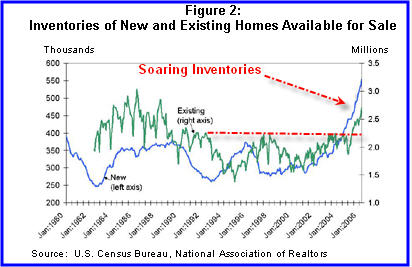

The following charts are from Berson's Weekly Commentary. Berson is an economist with Fannie Mae.

Month's Supply of Homes

Actual Inventory Supplies

If the months supply of homes does not seem that bad, it is because sales although falling sharply are still at historic levels, for now anyway. Meanwhile sentiment has clearly turned and is very unlikely to turn back anytime soon. That is the nature of supertankers, and housing is the supertanker that kept this economy going for so long.

CNN Money is reporting Rising Home Vacancies.

Experts who say the housing market is cooling, but won't implode, argue that solid job growth should be enough to prevent a collapse in home prices. But others who see a housing "bubble" ready to pop say a developing slowdown in home building itself could hurt job growth enough to put a big dent in housing.Housing will not collapse because of strong jobs, huh? Did it ever occur to these economic genuises that jobs have been strong because of housing? It is an interesting anecdote that a lumber supplier in Indian is laying off good "qualified people" because he simply has no choice. This trend will escalate.

Recent government figures show that about 1.5 million homes were vacant in the first quarter, most of those presumably up for sale, a 17 percent increase from a year earlier. The 2.1 percent vacancy rate was the highest on record since the government began tracking it in 1994. It was also the fourth straight quarterly increase.

"When you see it increasing quarter after quarter, there seems to be something going on here," Baker said. "We're building more homes than are being filled."

Among those most worried about the real estate market are home builders themselves. The National Association of Home Builders saw its index of builder confidence sink last month to the lowest level since 1995, save for two months right after Sept. 11.

But some economists say that while housing will cool as mortgages continue to rise, home sales and prices won't collapse, due mostly to strength in the job market.

One of those worried is James McShirley, owner of Sulphur Lumber near Indianapolis. He's already laying off staff and not filling open positions due to a slowdown in orders from his builder clients.

"We're holding off as much as we can because qualified people are hard to find," he said. "But there will come a point where we have to face that (more layoffs) and it could be soon."

McShirley said when he sees his clients cutting staff, and a local mortgage broker with 100 employees go out of business, he grows more worried.

"Those people losing their jobs are the classic home owners. This could be a vicious circle," he said.

It seems the PPI is spiraling out of control. But enquiring minds might be wondering if those prices being passed on? Dow Jones is reporting Cooper Swings To Loss on Rising Rubber,Oil Prices.

Cooper Tire & Rubber Co. (CTB) said Wednesday it swung to a first-quarter loss as price increases failed to offset rising raw-material costs.It would seem to me that the only reason to sell for a loss is because you can't raise prices.

Shares of Cooper Tire fell 0.7% to $12.60 in early trading.

The Findlay, Ohio, tire maker reported a loss of $5.2 million, or 8 cents a share, compared with net income of $5.2 million, or 7 cents, a year earlier. Sales rose 16% to $596.6 million from $514.1 million on better pricing and improved product mix, the company said.

Not only are the canaries chirping but so are the geese. An astute question was asked by "Shades" on Silicon Investor. It goes something like this: Why sell the goose if it still laying golden eggs? We are of course talking about the upcoming MasterCard IPO .

Credit card issuer MasterCard Inc. plans to price its IPO between $40 and $43 a share when it sells a $2.8 billion stake in the company later this month.So insiders are bailing via IPO to the public. There are lots of potential reasons for this.

A total of 61.5 million shares of Class A common stock, or 46% of the company's stock, is slated for the initial public offering some time in the fourth week of May. If there is sufficient demand, an additional 4.6 million shares will be sold in an over-allotment tranche, according to an updated prospectus filed by the company Wednesday.

If MasterCard succeeds at pricing its deal at the high end of its range, the Purchase, N.Y., company would be valued at $5.8 billion.

All but $650 million of the money raised in the IPO will be used to buy a portion of the Class B common stock stakes held by current owners of the closely held cooperative, who are members or affiliates of MasterCard's credit card network. About 30% of the proceeds will go to members and affiliates who are also underwriting the deal - including Wall Street underwriters JP Morgan Chase & Co. (JPM) and Citigroup Inc. (C). The remaining $650 million will be used to increase the company's capital, defend it in legal and regulatory proceedings, and for other general corporate purposes.

The deal, which is being lead-managed by Goldman Sachs Group Inc. (GS), will trade under the symbol MA on the New York Stock Exchange.

- Rising default rates

- Rising bankruptcies

- Fear of what a Democratic Congress might do to the bankruptcy law

- Fear of what a Democratic Congress might do to maximum allowed card rates

It is now time to "talk turkey".

Many people, myself included, commented on the capitulation of long time bear Stephen Roach. No one summed up the situation better than Peter Schiff writing on FinancialSense about "COOL HAND STEVE".

The most interesting aspect of his fox-hole conversion is his timing. Never before has his doomsday scenario been so close to unfolding or his bearishness so close to vindication. With the dollar resuming its fall, foreign central banks raising rates and seeking to diversify their reserves, housing supply overwhelming demand, and gold and other commodity prices soaring out of control, one would think Mr. Roach would finally be in the enviable position of saying "I told you so." Instead he has changed his tune, and now sings in near perfect harmony with the Wall Street's "All Bulls Choir."Lifelong bears turning bullish is a classic "chirping sound". Roach is now doomed to become roast turkey. We could see it coming too. For the last six months Stephen Roach has been all over the map. I commented on that on Silicon Investor as well as the Motley FOOL. Well he now finally capitulated just as a housing collapse is getting underway. The double dip recession that he called for in 2003 is now on its way.

Not only are the economic imbalances to which Stephen Roach repeatedly referenced still present, they loom larger than ever. Rather than swallowing their medicine, Americans continue choking on it. Roach can see this as clearly as I can, making his new stance difficult to understand. For my money Wall Street's most popular bear finally turning bullish is as bearish an indicator as I have ever seen, and may go down as the most ill-time capitulation in market history.

Mish Top 10 Bird Sounds

#10 Carry trades blowing up in New Zealand and Iceland

#09 Mideast stock markets crashing

#08 Home inventories and vacancies are skyrocketing

#07 St. Joe falling off a cliff

#06 MasterCard IPO

#05 Land prices being written off by two home builders

#04 Ameriquest firing close to 4,000 workers

#03 Inability of manufacturers to pass on skyrocketing costs

#02 The rise of gold and silver

Drum Roll Please.........

#01 The capitulation of Stephen Roach

Mish Addendum.

I posted the above earlier tonight but shortly thereafter I was able to discuss the above ideas on a podcast at HoweStreet. For those that are interested in an audio version with a few additional comments on oil and gold, please tune in to Chirping Birds.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/