The Sorry State of US Govt Accounting Practices

Mish Moved to MishTalk.Com Click to Visit.

I just finished reading the US Government’s consolidated financial statements for the fiscal year ending September 30, 2005.

If you wish to read the full report, be forewarned that it is a 158 page PDF.

Following are some interesting snips. Notes:

1)Page number refers to the PDF page number not the page on the Government report

2)Click on any chart for a larger view (the first one is already full size)

Starting off on page 14 we see a budget deficit of $319 Billion.

Disclaimers

On pages 31-33 we find these disclaimers by the US Government Accountability Office:

- Material deficiencies in financial reporting (which also represent material weaknesses and other limitations on the scope of our work resulted in conditions that, for the ninth consecutive year, prevented us from expressing an opinion on the federal government’s consolidated financial statements.

- The federal government did not maintain effective internal control over financial reporting (including safeguarding assets) and compliance with significant laws and regulations as of September 30, 2005.

Three major impediments to our ability to render an opinion on the consolidated financial statements continued to beThe above notes were signed off by David M. Walker, Comptroller General of the United States.

(1) serious financial management problems at the Department of Defense,

(2) the federal government’s inability to adequately account for and reconcile intragovernmental activity and balances between federal agencies, and

(3) the federal government’s ineffective process for preparing the consolidated financial statements.

Moreover, as a result of the material deficiencies we found, readers are cautioned that amounts reported in the consolidated financial statements and related notes, certain information contained in the accompanying Management’s Discussion and Analysis, and other financial management information that is taken from the same data sources as the consolidated financial statements, may not be reliable. Until the problems discussed in our audit report are adequately addressed, they will continue to have adverse implications for the federal government and the taxpayers, which are outlined in our report.

More troubling still, the federal government’s financial condition and long-term fiscal outlook is continuing to deteriorate. While the fiscal year 2005 budget deficit was lower than 2004, it was still very high, especially given the impending retirement of the “baby boom” generation and rising health care costs. Importantly, the federal government’s accrual based net operating cost increased to $760 billion in fiscal year 2005 from $616 billion in fiscal year 2004.

The current financial reporting model does not clearly and transparently show the wide range of responsibilities, programs, and activities that may either obligate the federal government to future spending or create an expectation for such spending. Thus, it provides a potentially unrealistic and misleading picture of the federal government’s overall performance, financial condition, and future fiscal outlook. The federal government’s gross debt in the consolidated financial statements was about $8 trillion as of September 30, 2005.

This number excludes such items as the gap between the present value of future promised and funded Social Security and Medicare benefits, veterans’ health care, and a range of other liabilities (e.g., federal employee and veteran benefits payable), commitments, and contingencies that the federal government has pledged to support. Including these items, the federal government’s fiscal exposures now total more than $46 trillion, up from about $20 trillion in 2000. This translates into a burden of about $156,000 per American or approximately $375,000 per full-time worker, up from $72,000 and $165,000 respectively, in 2000. These amounts do not include future costs resulting from Hurricane Katrina or the conflicts in Iraq and Afghanistan. Continuing on this unsustainable path will gradually erode, if not suddenly damage, our economy, our standard of living, and ultimately our national security.

Addressing the nation’s long-term fiscal imbalance constitutes a major transformational challenge that may take a generation or more to resolve. Given the size of the projected deficit, the U.S. government will not be able to grow its way out of this problem—tough choices are required.

Gross and Net Costs by Department

On page 40 there is a nice table of gross and next expenditures by departments:

Revenue vs. Spending

The following table shows that we are currently spending $760 Billion more than we take in. Furthermore, you can clearly see that taxpayers as opposed to corporations are bearing the big brunt of government spending.

Unfunded Liabilities

A Mish telepathic question just came in:

Why is the budget deficit reported as $319 billion and not $760 billion?

It just so happens there is an answer to this question on page 42.

Table of Unfunded Liabilities (partial table shown here)

The government cleverly subtracts unfunded liabilities from the budget

as if they do not matter. This results in ....

Unified Budget Deficit.............. (318.5) (412.3) for 2005 2004

Heck, it seems we could balance the budget overnight with this insane accounting practice.

All we have to do is not fund another $318.5 billion in liabilities. Voila. Balanced Budget.

Assets

Page 44 has a nice table of assets.

Back on Page 15 is this note tucked away about assets.

The Government’s total assets increased from $1,397.3 billion as of the end of fiscal year 2004 to $1,456.1 billion as of the end of fiscal year 2005. This increase was due to increases in all of the Government’s assets except its cash and other monetary assets, which declined slightly. Representing almost 50 percent of total assets this fiscal year, net property, plant, and equipment has been the Government’s largest asset over the past 7 fiscal years. In fact, the reported value of these assets increased substantially in fiscal year 2003 as a result of a change in Federal accounting standards. This change resulted in the recognition of a net book value of $325.1 billion in military equipment being presented on the balance sheet for the first time.Liabilities

Social Security

In 2004, there were about 30 beneficiaries for every 100 workers. By 2030, there will be about 46 beneficiaries for every 100 workers. A similar demographic pattern confronts the Medicare Program. For example, for the HI Program, there were about 26 beneficiaries for every 100 workers in 2004; by 2030 there are expected to be about 42 beneficiaries for every 100 workers. This ratio for both programs will continue to increase to about 50 beneficiaries for every 100 workers by the end of the projection period, after the baby-boom generation has moved through the Social Security system due to declining birth rates and increasing longevity.A chart for Social Security showing the number of beneficiaries per 100 workers can be found on page 54:

Social Security Expenditures minus Income

Currently, Social Security tax revenues exceed benefit payments and will continue to do so until 2017, when revenues are projected to fall below benefit payments, after which the gap between expenditures and revenues continues to widen.

Medicare Projections

On December 8, 2003, President Bush signed into law the Medicare Prescription Drug, Improvement, and Modernization Act of 2003. The 2003 law will have a major impact on the operations and finances of Medicare. The law adds a prescription drug benefit to Medicare beginning in 2006 and a new prescription drug account in the SMI Trust Fund. The benefit could be obtained through a private drug-only plan, a private preferred-provider organization or health maintenance organization, or through an employer-sponsored retiree health plan. The preferred-provider organizations will be new to the Medicare Program and will operate on a regional basis. The Federal Government will assume some of the costs of providing prescription drug coverage to people eligible for both Medicare and Medicaid.

The legislation also includes provisions not related to the prescription drug benefit. It includes increases in Medicare provider reimbursements, higher Medicare Part B premiums for people at higher income levels, and an expansion of tax-deductible health savings accounts. The 2003 legislation is expected to have a significant effect on future Medicare finances as seen below and earlier in the Statement of Social Insurance.

Health Care Cost Growth

In addition to the growth in the number of beneficiaries per worker, the Medicare Program has the added pressure of expected growth in the use and cost of health care per person. Continuing development and use of new technology is expected to cause health care expenditures to grow faster than GDP in the long run. For the intermediate assumption, health care expenditures per beneficiary are assumed to grow one percentage point faster than per capita GDP over the long range.

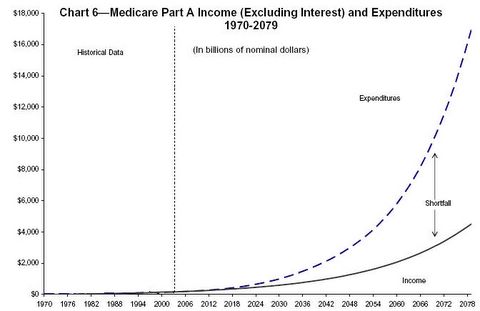

The following chart shows Medicare, Part A (Hospital Insurance) - Nominal Income and Expenditures. Medicare Part A funds the cost of inpatient hospital and related care for individuals age 65 or older who meet certain insured status requirements, and eligible disabled people. The program is financed primarily by payroll taxes, including those paid by Federal agencies. It also receives income from interest earnings on Treasury securities and a portion of income taxes collected on Social Security benefits.

The chart can be found on page 61. It shows historical and actuarial estimates of HI annual income (excluding interest) and expenditures for 1970-2079 in nominal dollars. The estimates are for the open-group population. The figure reveals a widening gap between income and expenditures after 2004.

Medicare Part A Expenditures minus Income

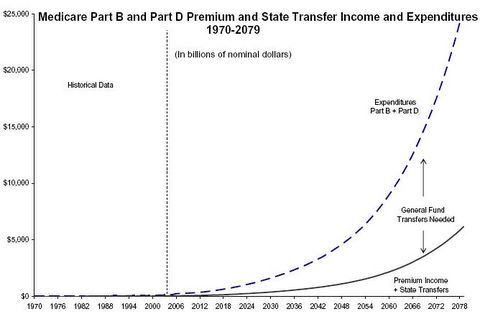

The following chart shows Medicare Parts B and D (Supplementary Medical Insurance).

Medicare Part B provides supplementary medical insurance for enrolled eligible participants to cover physician and outpatient services not covered by Medicare Part A. Medicare Part B financing is based on monthly premiums and income from the General Fund of the Treasury. The chart can be found on page 64. It shows historical and actuarial estimates of Medicare Part B and Part D premiums (and Part D State transfers) and expenditures for each of the next 75 years, in nominal dollars. The gap between premiums and State transfer revenues and program expenditures grows throughout the projection period. That gap that will need to be filled with transfers from general revenues.

Medicare Parts B & D Expenditures minus Income

The above charts show that the expenditure rate exceeds the income rate beginning in 2004, and cash deficits continue thereafter.

Trust fund interest earnings and assets provide enough resources to pay full benefit payments until 2020 with general revenues used to finance interest and loan repayments to make up the difference between cash income and expenditures during that period. Pressures on the Federal budget will thus emerge well before 2020. Present tax rates would be sufficient to pay 79 percent of scheduled benefits after trust fund exhaustion in 2020 and 27 percent of scheduled benefits in 2079.

Gold

On page 89 we find the only possible bright spot. It seems the government has undervalued our gold by as much as $350-$400 per ounce at current prices.

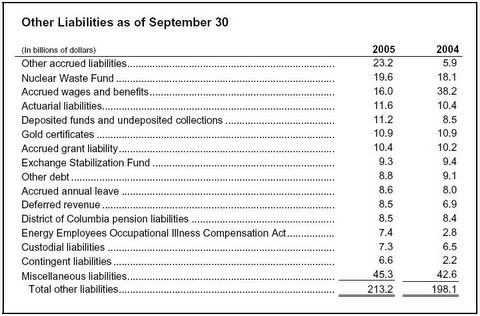

Gold is valued at the statutory price of $42.2222 per fine troy ounce. The number of fine troy ounces was 258,713,310 as of September 30, 2005, and 2004. The market value of gold on the London Fixing as of the reporting date was $473 and $416 per fine troy ounce for the years ended September 30, 2005, and 2004, respectively. Gold totaling $10.9 billion for the years ending September 30, 2005, and 2004, was pledged as collateral for gold certificates issued and authorized to the FRBs by the Secretary of the Treasury. Treasury may redeem the gold certificates at any time.Other Liabilities

On page 109 is a table of "Other Liabilities".

Trust Funds

- Federal Old-Age and Survivors Insurance Trust Fund

- Civil Service Retirement and Disability Fund

- Federal Hospital Insurance Trust Fund (Medicare Part A)

- Federal Disability Insurance Trust Fund

- Medicare-Eligible Retiree Health Care Fund

- Unemployment Trust Fund

- Federal Supplementary Medical Insurance Trust Fund (Medicare Part B)

- Railroad Retirement Trust Fund

- Land and Water Conservation Fund

- Foreign Service Retirement and Disability Fund

- National Service Life Insurance Fund

- Airport and Airway Trust Fund

- Highway Trust Fund

- Hazardous Substance Superfund

- Black Lung Disability Trust Fund

- Indian Trust Funds

Please bear in mind there is no trust fund nor is there a lock box as money is not set aside for future use. Year in and year out more money is spent than taken in and nothing is set aside in any trust. The "Trust Fund" is a total figment of imagination on any kind of reasonable accounting system. Proof of that is simple enough: Just look at assets compared to liabilities, deficit spending, unfunded liabilities, the national debt, and future projections.

GAO Audit

Those still suffering through that massive report will notice the following disclaimers from the Government Accountability Office, starting on page 139 and pretty much continuing for the rest of the document. Following are some of the lowlights:

A significant number of material weaknesses related to financial systems, fundamental recordkeeping and financial reporting, and incomplete documentation continued to (1) hamper the federal government’s ability to reliably report a significant portion of its assets, liabilities, costs, and other related information; (2) affect the federal government’s ability to reliably measure the full cost as well as the financial and nonfinancial performance of certain programs and activities; (3) impair the federal government’s ability to adequately safeguard significant assets and properly record various transactions; and (4) hinder the federal government from having reliable financial information to operate in an economical, efficient, and effective manner. We found the following: Material deficiencies in financial reporting (which also represent material weaknesses)and other limitations on the scope of our work resulted in conditions that continued to prevent us from expressing an opinion on the accompanying consolidated financial statements for the fiscal years ended September 30, 2005 and 2004.

The federal government did not maintain effective internal control over financial reporting (including safeguarding assets) and compliance with significant laws and regulations as of September 30, 2005.

Our work to determine compliance with selected provisions of significant laws and regulations in fiscal year 2005 was limited by the material weaknesses and scope limitations discussed in this report.

Disclaimer of Opinion on the Consolidated Financial Statements

Because of the federal government’s inability to demonstrate the reliability of significant portions of the U.S. government’s accompanying consolidated financial statements for fiscal years 2005 and 2004, principally resulting from the material deficiencies, and other limitations on the scope of our work, described in this report, we are unable to, and we do not, express an opinion on such financial statements.

As a result of the material deficiencies in the federal government’s systems, recordkeeping, documentation, and financial reporting and scope limitations, readers are cautioned that amounts reported in the consolidated financial statements and related notes may not be reliable. These material deficiencies and scope limitations also affect the reliability of certain information contained in the accompanying Management’s Discussion and Analysis and other financial management information—including information used to manage the government day to day and budget information reported by federal agencies—that is taken from the same data sources as the consolidated financial statements.

The Nation’s Fiscal Imbalance

While we are unable to express an opinion on the U.S. government’s consolidated financial statements, several key items deserve emphasis in order to put the information contained in the financial statements and the Management’s Discussion and Analysis section of the Financial Report of the United States Government into context. First, while the reported $319 billion fiscal year 2005 unified budget deficit was significantly lower than the $412 billion unified budget deficit in fiscal year 2004, it was still very high given current economic growth rates and the overall composition of federal spending.

Furthermore, the federal government’s reported net operating cost, which included expenses incurred during the year, increased to $760 billion in fiscal year 2005 from $616 billion in fiscal year 2004. Second, the U.S. government’s total reported liabilities, net social insurance commitments 9 and other fiscal exposures continue to grow and now total more than $46 trillion, representing close to four times current GDP and up from about $20 trillion or two times GDP in 2000. Finally, while the nation’s long-term fiscal imbalance continues to grow, the retirement of the “baby boom” generation is closer to becoming a reality with the first wave of boomers eligible for early retirement under Social Security in 2008. Given these and other factors, it seems clear that the nation’s current fiscal path is unsustainable and that tough choices by the President and the Congress are necessary in order to address the nation’s large and growing long-term fiscal imbalance.

Adverse Opinion on Internal Control

Because of the effects of the material weaknesses discussed in this report, in our opinion, the federal government did not maintain effective internal control as of September 30, 2005, to meet the following objectives: (1) transactions are properly recorded, processed, and summarized to permit the preparation of the financial statements and stewardship information in conformity with GAAP, and assets are safeguarded against loss from unauthorized acquisition, use, or disposition; and (2) transactions are executed in accordance with laws governing the use of budget authority and with other significant laws and regulations that could have a direct and material effect on the financial statements and stewardship information. Consequently, the federal government’s internal control did not provide reasonable assurance that misstatements, losses, or noncompliance material in relation to the financial statements or to stewardship information would be prevented or detected on a timely basis. Our adverse opinion on internal control over financial reporting and compliance is based upon the criteria established under FMFIA. Individual federal agency financial statement audit reports identify additional reportable conditions in internal control, some of which were reported by agency auditors as being material weaknesses at the individual agency level.

David M. Walker

Comptroller General of the United States

December 2, 2005

What the government is willing to admit is rather amazing.

Perhaps they are hoping no one reads these things.

I suggest we would all be better off if these reports were required reading for every high school in the country.

http://globaleconomicanalysis.blogspot.com/