Panic Over Oil

Mish Moved to MishTalk.Com Click to Visit.

Sometimes I am nearly speechless over dumb ideas coming from this Congress. This is one of those times. Please consider the CNN article Senators to push for $100 gas rebate checks.

Most American taxpayers would get $100 rebate checks to offset the pain of higher pump prices for gasoline, under an amendment Senate Republicans hope to bring to a vote soon. "Our plan would give taxpayers a hundred dollar gas tax holiday rebate check to help ease the pain that they're feeling at the pump," Senate Majority Leader Bill Frist announced Thursday.Gas Tax Moratorium

"It also includes strong federal anti-price gouging protection to protect consumers against anti-competitive behavior by oil companies or other suppliers of gasoline. Our free market system works, but it works best when there's full accountability and full transparency."

Frist said the rebates would go to single taxpayers making less than $125,000 per year, and couples making less than $150,000.

Republican senators said they hoped soaring gas prices would inspire Democrats to support their proposals.

The Democrats were inspired alright, inspired to come up with their own silly plan.

Democrats Propose 60-day Moratorium on Gasoline Tax.

Following President Bush's four-point plan outlined today, Democrats proposed legislation that would put a moratorium on the Federal gasoline tax for at least 60-days to provide consumers immediate relief at the pump. But the proposed legislation would also chop oil company tax benefits and burden refineries with unwarranted reporting requirements, making it unable to win enough support in Congress to have even a remote chance of passing.On the whole, the Republican plan is far dumber. But both plans want government to investigate "price gouging". Let's be serious here. Is there any evidence of price gouging? How much are we going to waste trying to determine if there is price gouging? Heck, why not give the contract to Halliburton?

For years, Democrats have been fighting to get tough on Big Oil and protect Americans from being exploited when they fuel their cars," said Senate Democratic Leader "give em hell Harry" Reid. "Unfortunately, for years Republicans have been more interested in protecting oil companies' profits than the American people's pockets. Now that gas prices are skyrocketing and Americans are struggling just to fill their gas tanks, Congress must act to ease the burden. Passing a federal gas tax holiday and repealing the tax giveaways in the Bush energy bill is a good start."

The Menendez Federal Gas Tax Holiday Amendment, an amendment to the Supplemental Appropriations Bill under debate in the U.S. Senate right now, will give Americans immediate relief from gas prices right at the pump by removing the $0.184 per gallon federal tax on gasoline and the $0.244 per gallon federal tax on diesel for 60 days. To recover the lost revenue, the amendment repeals huge and unnecessary subsidies for large oil companies included in the Bush energy bill and other legislation and handed out at a time when oil companies were enjoying record profits.

"More than six months ago, Democrats, led by Congressman Bart Stupak of Michigan, introduced legislation that gives the Federal Trade Commission (FTC) explicit authority to investigate and prosecute companies engaged in price gouging. Congressional Republicans voted three times against acting on this Stupak legislation.

"Democrats, led by Congressman Brian Higgins of New York, introduced a bill that would rescind billions of dollars in taxpayer subsidies for these oil companies, roll back these subsidies, tax breaks, and royalty relief given to big oil and big gas companies, and use those funds to help low-income Americans, farms, and small-businesses struggling under the weight of gas prices. And yes, the Republicans voted over and over against rolling back the subsidies even after they knew the oil companies were making historic, obscene, and record profits.

Free Money

Now I am all in favor of lower taxes, but I am also in favor of lower spending. Neither plan comes close but the Republican plan seems like it is from Mars. Is there a fiscal conservative Republican anywhere to be found? Other than Ron Paul, who? When I first read the idea of free $100 bills I thought I was reading something from "The Onion".

How can anyone possibly think that "free money" can be given away with no repercussions? What planet are our senators and congressman from anyway? Isn't the national debt big enough already? If not, why stop at $100. Heck why not give every citizen in the country $100,000? That would buy a lot of gas. Or would it? Perhaps gas would go to $150 a gallon or more if they did that. Who knows? All I know is that there is no such thing as free money.

Strategic Oil Reserves Halted

Bloomberg is reporting Bush Halts Oil Reserve Deposits, Plans Fuel Waivers

President George W. Bush, facing voter concern over soaring fuel prices, said he will free up oil that is being added to the nation's emergency reserves and waive rules that are creating bottlenecks in U.S. gasoline markets.Let's do a quick calculation. We import 10,000,000 barrels a day of which 25,000 goes to the strategic reserves. My math says that will help by 1/4 of 1%. In other words, Bush is touting something that is statistically irrelevant.

Bush, in a speech today in Washington to the trade group for ethanol producers, said the country should raise fuel efficiency and develop alternatives to oil. He also ordered the Justice Department to look for possible price manipulation.

"We'll leave a little more oil on the market" by halting deliveries to the reserves, Bush said. "Every little bit helps."

Bush and Republicans in Congress face growing pressure from voters as crude oil soars to a record and gasoline pump prices near the all-time high reached after Hurricane Katrina last year. A CNN poll released yesterday showed 69 percent of U.S. adults say higher fuel costs are causing financial hardship.

The Energy Department will suspend deposits to the Strategic Petroleum Reserve through the end of summer, which is the period of peak demand in the U.S., Bush said.

Because the stockpile is nearly full, the effect of the halt may be minimal. The government has been adding an average of about 25,000 barrels of oil per day to the reserve so far this year. The U.S. imports about 10 million barrels a day.

"The first thing to do is to make sure Americans are treated fairly at the gas pump," Bush said. "This administration is not going to tolerate manipulation."

Boone Pickens, the Dallas hedge fund manager and a Bush supporter, said he was disappointed that Bush is talking about investigations.

"There's not anything there. There's not anybody gouging," Pickens said in an interview today at the Milken Institute conference in Los Angeles. "You have the Federal Trade Commission looking at gasoline prices every day."

Ethanol Tax Credits and Tariffs

There are currently tax credits of 51 cents per gallon for suppliers and an extra 10 cent per gallon tax credit to provide extra help to small ethanol producers and farmers. If it takes 61 cents in tax credits to make something profitable for corn growers then that is 61 cents in tax credits not wisely spent. All Congress is doing is wasting taxpayer money by buying votes.

This should be proof enough: Brazil Finance Minister Asks US To End Ethanol Tariff.

Brazil's Finance Minister Guido Mantega asked the U.S. government to reconsider a tariff on imports of ethanol from Brazil, the Valor newspaper said Monday.Here we are supposedly struggling to lower gas prices and a non-opec country wants to supply us with cheaper ethanol than we can produce it, and this administration says "no thanks". Instead we worry about non-existent price gouging. Go figure.

The U.S. currently slaps a tariff of $0.54 per gallon on Brazilian ethanol, mainly to protect domestic producers of the alternative fuel, who produce it far more expensively than Brazilians. But U.S. farmers are having difficulties keeping up with rising demand as refiners are substituting the gasoline additive MTBE with ethanol.

The tariff "is worse for the U.S. itself, as it makes the ethanol the country needs more expensive," Mantega is quoted as saying.

In a presentation, Mantega said that Brazilian ethanol currently had a cost of about $20 a barrel and that the fuel is an important piece in the search for cleaner energy sources.

By the way, Chris Puplava on FinancialSense produced some great charts in an article entitled ENERGY ECONOMICS 101 that make a mockery of gouging claims.

Breakup Oil Firms Proposal

Is that the end of dumb ideas coming from Congress about oil? By now, Mish readers know the answer to questions like that automatically: "of course not". Please consider a proposal by senator Charles Schumer (D-NY) to breakup oil firms.

"We also have to reexamine whether having only a handful of giant oil companies can coexist with the needs of the American consumer and a rational energy policy in this country -- I do not believe it does," Schumer declared. "And so I'll be offering an amendment to the supplemental that will require a complete examination as to whether or not we should break up the big oil companies."How long ago was it that we broke up "Ma Bell" only to allow it to be put back together piece by piece? Was anything accomplished? If so what?

"Enough is enough," the New York senator added. "We have no competition. There are signs of it. I've talked to business leaders who buy oil and gas products, major, conservative Republican business leaders, and they don't believe the market is on the level."

“If $75 a barrel, $3 a gallon isn't a wake-up call to this country, then what is?

“And prices are going to continue to go up. If we do nothing, we'll look back at the days when it was $3 a gallon, and say, "Boy, that was a lot better than it is today."

“So we need to do three things -- and we are pushing for three things in the real security package that the House and Senate leadership -- Democratic leadership on both sides -- have put together.

“First, we have to dramatically increase conservation. We're not doing any of that. The fact that China has higher mileage standards than we do should make us weep. And China is not a country caring about the environment -- they're doing it just to keep their economic strength.

What is gold telling us?

On April 25th, Ron Paul, perhaps the only person in Congress with any clues gave a congressional speech about What the Price of Gold is Telling Us. Following are the key snips in a very lengthy article.

Since 2001 however, interest in gold has soared along with its price. With the price now over $600 an ounce, a lot more people are becoming interested in gold as an investment and an economic indicator. Much can be learned by understanding what the rising dollar price of gold means.Panic Time

The rise in gold prices from $250 per ounce in 2001 to over $600 today has drawn investors and speculators into the precious metals market. Though many already have made handsome profits, buying gold per se should not be touted as a good investment. After all, gold earns no interest and its quality never changes. It’s static, and does not grow as sound investments should.

It’s more accurate to say that one might invest in a gold or silver mining company, where management, labor costs, and the nature of new discoveries all play a vital role in determining the quality of the investment and the profits made.

Buying gold and holding it is somewhat analogous to converting one’s savings into one hundred dollar bills and hiding them under the mattress-- yet not exactly the same. Both gold and dollars are considered money, and holding money does not qualify as an investment. There’s a big difference between the two however, since by holding paper money one loses purchasing power. The purchasing power of commodity money, i.e. gold, however, goes up if the government devalues the circulating fiat currency.

One of the characteristics of commodity money-- one that originated naturally in the marketplace-- is that it must serve as a store of value. Gold and silver meet that test-- paper does not. Because of this profound difference, the incentive and wisdom of holding emergency funds in the form of gold becomes attractive when the official currency is being devalued. It’s more attractive than trying to save wealth in the form of a fiat currency, even when earning some nominal interest. The lack of earned interest on gold is not a problem once people realize the purchasing power of their currency is declining faster than the interest rates they might earn. The purchasing power of gold can rise even faster than increases in the cost of living.

The point is that most who buy gold do so to protect against a depreciating currency rather than as an investment in the classical sense. Americans understand this less than citizens of other countries; some nations have suffered from severe monetary inflation that literally led to the destruction of their national currency. Though our inflation-- i.e. the depreciation of the U.S. dollar-- has been insidious, average Americans are unaware of how this occurs. For instance, few Americans know nor seem concerned that the 1913 pre-Federal Reserve dollar is now worth only four cents. Officially, our central bankers and our politicians express no fear that the course on which we are set is fraught with great danger to our economy and our political system. The belief that money created out of thin air can work economic miracles, if only properly “managed,” is pervasive in D.C.

In many ways we shouldn’t be surprised about this trust in such an unsound system. For at least four generations our government-run universities have systematically preached a monetary doctrine justifying the so-called wisdom of paper money over the “foolishness” of sound money. Not only that, paper money has worked surprisingly well in the past 35 years-- the years the world has accepted pure paper money as currency. Alan Greenspan bragged that central bankers in these several decades have gained the knowledge necessary to make paper money respond as if it were gold. This removes the problem of obtaining gold to back currency, and hence frees politicians from the rigid discipline a gold standard imposes.

The number of dollars created by the Federal Reserve, and through the fractional reserve banking system, is crucial in determining how the market assesses the relationship of the dollar and gold. Though there’s a strong correlation, it’s not instantaneous or perfectly predictable. There are many variables to consider, but in the long term the dollar price of gold represents past inflation of the money supply. Equally important, it represents the anticipation of how much new money will be created in the future. This introduces the factor of trust and confidence in our monetary authorities and our politicians. And these days the American people are casting a vote of “no confidence” in this regard, and for good reasons.

The incentive for central bankers to create new money out of thin air is twofold. One is to practice central economic planning through the manipulation of interest rates. The second is to monetize the escalating federal debt politicians create and thrive on.

Today no one in Washington believes for a minute that runaway deficits are going to be curtailed. In March alone, the federal government created an historic $85 billion deficit. The current supplemental bill going through Congress has grown from $92 billion to over $106 billion, and everyone knows it will not draw President Bush’s first veto.

Current policy guarantees that the integrity of the dollar will be undermined. Exactly when this will occur, and the extent of the resulting damage to financial system, cannot be known for sure-- but it is coming. There are plenty of indications already on the horizon.

Foreign policy plays a significant role in the economy and the value of the dollar. A foreign policy of militarism and empire building cannot be supported through direct taxation. The American people would never tolerate the taxes required to pay immediately for overseas wars, under the discipline of a gold standard. Borrowing and creating new money is much more politically palatable. It hides and delays the real costs of war, and the people are lulled into complacency-- especially since the wars we fight are couched in terms of patriotism, spreading the ideas of freedom, and stamping out terrorism. Unnecessary wars and fiat currencies go hand-in-hand, while a gold standard encourages a sensible foreign policy.

It’s a mistake to blame high gasoline and oil prices on price gouging. If we impose new taxes or fix prices, while ignoring monetary inflation, corporate subsidies, and excessive regulations, shortages will result. The market is the only way to determine the best price for any commodity. The law of supply and demand cannot be repealed. The real problems arise when government planners give subsidies to energy companies and favor one form of energy over another.

Energy prices are rising for many reasons: Inflation; increased demand from China and India; decreased supply resulting from our invasion of Iraq; anticipated disruption of supply as we push regime change in Iran; regulatory restrictions on gasoline production; government interference in the free market development of alternative fuels; and subsidies to big oil such as free leases and grants for research and development.

Meaning of the Gold Price-- Summation

A recent headline in the financial press announced that gold prices surged over concern that confrontation with Iran will further push oil prices higher. This may well reflect the current situation, but higher gold prices mainly reflect monetary expansion by the Federal Reserve. Dwelling on current events and their effect on gold prices reflects concern for symptoms rather than an understanding of the actual cause of these price increases. Without an enormous increase in the money supply over the past 35 years and a worldwide paper monetary system, this increase in the price of gold would not have occurred.

Economic law dictates reform at some point. But should we wait until the dollar is 1/1,000 of an ounce of gold or 1/2,000 of an ounce of gold? The longer we wait, the more people suffer and the more difficult reforms become. Runaway inflation inevitably leads to political chaos, something numerous countries have suffered throughout the 20th century. The worst example of course was the German inflation of the 1920s that led to the rise of Hitler. Even the communist takeover of China was associated with runaway inflation brought on by Chinese Nationalists. The time for action is now, and it is up to the American people and the U.S. Congress to demand it.

Compare and contrast the fiscal sanity and wisdom of Ron Paul with the idea of giving every citizen $100 "free money" to help counteract rising gas prices.

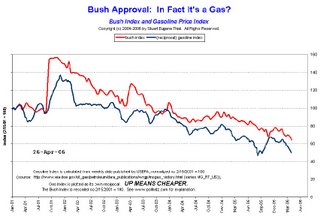

It seems to me Bush and the Republican Congress and practically everyone else except for Ron Paul is in a panic over oil. Perhaps the following chart with thanks to Professor Pollkatz, just might explain why. For a much larger and easier to read gif file please click here.

The reason we are in such dire fiscal straights is there are too many politicians with their hands in the till, too many politicians that see nothing wrong with buying votes, too many politicians that do not understand what inflation really is, and quite frankly too many jackasses running the country counterbalanced by one Ron Paul whom everyone ignores.

Mike Shedlock / Mish

http://globaleconomicanalysis.blogspot.com/